The last two years have been among the worst for investors in China’s equity markets. Our monthly newsletter last month On China: Are We There Yet? outlined the various factors that drove equities to plumb the depths of despair, the likes of which many of us in our rather long working careers would find hard to find parallels with. But like the darkness precedes dawn, every bear market must have an end. And, as is commonly known, the seeds of the next bull market are sown in that depression and nadir that accompany the tail-end of a bear market.

China’s reopening is the hot topic today for investors: to fathom what it might look like, what sectors will stand out as the primary beneficiaries of such an opening and how investors can best position themselves for it. We carry on from where we left off last month and share some of our observations below.

Since the Party Congress concluded, China’s leadership has begun to take several steps that suggest that it is now prepared to exit the Covid-19 lockdowns it had placed the country under for several months, but with a clear strategy in place and possibly a timeline. The timeline is what is not spelt out, but several actions we enumerate below are a clear departure from where we were two months ago. These give sufficient indications that this time the authorities are moving with the objectives to safeguard public health and allow mobility and hence enable economic activity to reach normalcy in a finite period.

- On the vaccine/medication development front, an inhalable vaccine by CanSino has been adopted post the Party Congress and could be rolled out to more provinces;

- BioNTech has been approved for foreign residents in China after the German Chancellor Scholz met with President Xi and Premier Li on November 4;

- Two domestically-produced mRNA vaccines (CSPC and Abogen) are due to release data readouts soon. Vaccine production capacity has been created and is being expanded rapidly to meet the surge in demand once the vaccines are approved for distribution;

- Mass local production of Paxlovid could begin shortly, with Pfizer’s local partner Huahai equipped with 60 tons capacity and a recently-signed agreement with Ascletis for ritonavir supply (capacity of 530mn tablets);

- The Aviation Bureau has increased the number of international flights between November 22 and March 23 by more than 100% yoy (that remains ~ 3-5% of 2019 levels);

- China’s NHC on December 7 unveiled ten new Covid-19 measures including relaxations on home quarantine for some and lowering virus test requirements, being key among other relaxations;

- On the same day, the Politburo meeting statement set the tone for next year – economic growth will be top priority rather than Covid-19 containment.

If China achieves the prerequisites for reopening i.e. a very high elderly vaccination rate and adequate Covid-19 medications, then next spring, i.e. post the Lunar New Year peak travel rush and next March’s Two Sessions when the reshuffling of government officials takes place, could be the time window when China finally begins to exit its zero-Covid policy.

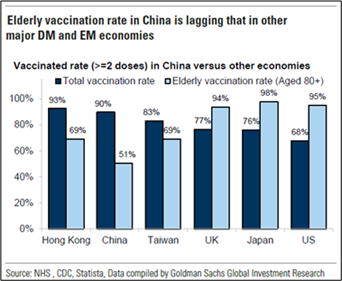

The biggest enabler of control over the spread of the virus globally has been the effective and rapid vaccination of the adult population and, vitally, the elderly. China’s is going to be no different from the path taken by other countries. China has lagged other economies in its ability to vaccinate its elderly fast enough and with a vaccine that has proven efficacy (see the chart alongside). It sees this as its biggest weakness in opening too soon and putting its large elderly populace at severe risk. A successful vaccine approval and roll-out is therefore going to be a critical event to watch out for and which will lift spirits in Chinese society just as much as it will bring hope and optimism to investors globally.

Once that milestone is reached, we expect that the stock market, which has already ‘read the tea-leaves’ well and rallied forth last month and into December as well, will likely see wider participation of investors coming back.

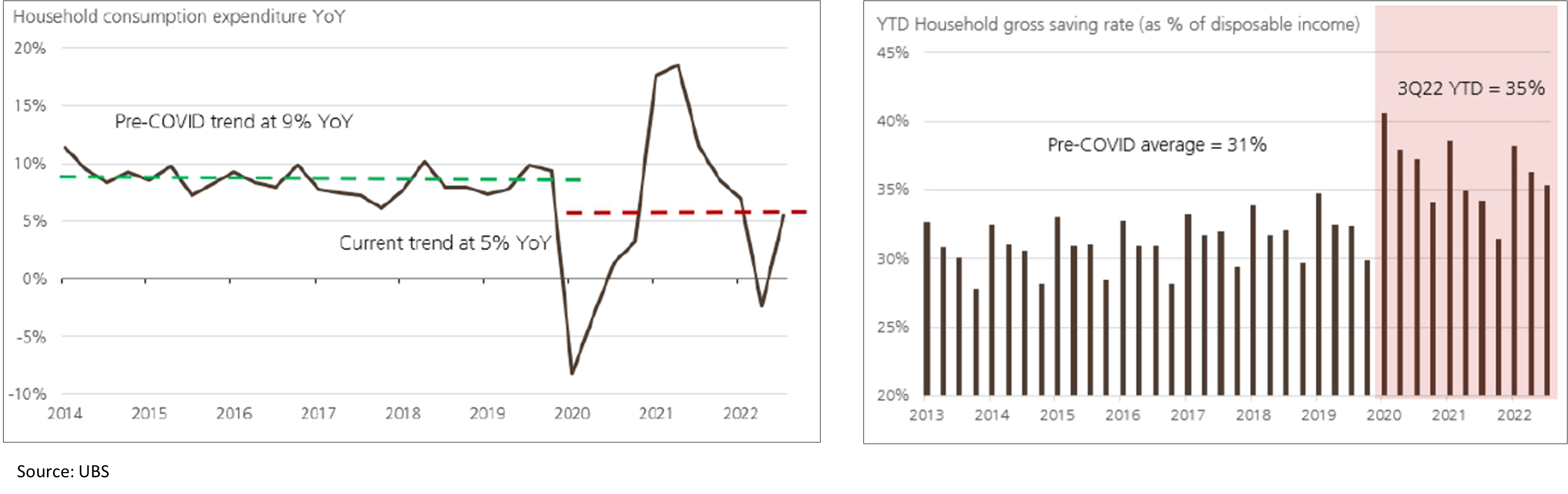

A recovery in consumption-related sectors remains the first big area of opportunity for Chinese equities in 2023. Consumer-related sectors and sub-groups have grown slower than income over the last few years as consumers increased savings considering the uncertain macro environment and restriction to their mobility. Experiences of reopening of economies of other Asian countries and the US are a useful and good place to start:

- It is observed that mobility restrictions have a much stronger impact on consumption than on infection numbers;

- Goods consumption tends to recover faster while services recovery tends to take longer;

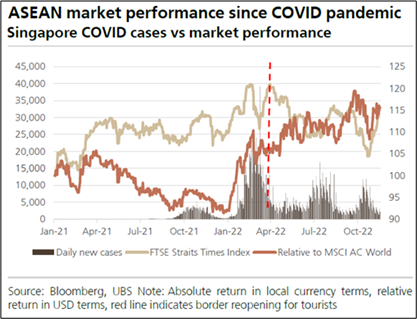

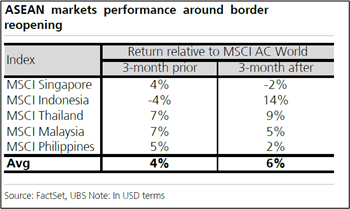

- Stock markets generally performed well three months before and after actual re-opening (see charts below).

Experiences From The Reopening In ASEAN

In the early part of 1Q22, Covid restrictions remained or were sometimes escalated, e.g. stricter measures were applied to Metro Manila throughout January in response to Omicron. Expect similar tightening in China as well, but stay focussed on the end-game.

- Mobility restrictions had a much bigger impact on consumption than case numbers. Once re-opening began, it took governments between three and six months to remove most of the Covid restrictions.

- Post-reopening, consumption responded quickly but recovery seemed to trend back towards pre-Covid growth rates. We note that it did not claw back all the losses incurred during the Covid outbreaks soon after re-opening.

- It must also be remembered that consumption for ASEAN countries was adversely affected by higher inflation which could have erased some of the benefit that could otherwise have come through.

- Stock markets for ASEAN countries outperformed three months before and after re-opening.

Reopening Experiences From Other Asian Economies

The reopening experience of the North Asian economies was more mixed. Consumption in Korea was less impacted and had a much faster recovery to trend growth there. Japan and Taiwan took longer to take off post reopening – more than nine months. Re-opening did not result in major outperformance in these markets given the export-oriented nature of many of their businesses.

Two important market implications emerge:

- Domestic-oriented and consumer-facing sectors tend to respond more favourably and quickly to reopening stimulus; and

- Domestic reopening through reduction of social-distancing, testing and isolation/lockdown measures which often preceded relaxation of international travel restrictions, had greater influence on equity market returns.

From investors’ perspective, it should suffice to believe that the market will rally broadly over time as the economy reopens through 2023. The sequence of beneficiaries as outlined above might vary and even change as the rally takes hold. Key reopening beneficiaries in sectors that are consumer-facing and consumption-led, including Internet companies, have already been the first ones off the blocks. These include companies in the hospitality, travel and tourism sectors such as online travel agencies, airlines, duty-free shop operators, etc. Other sub-groups such as specialty retailers, media & entertainment, restaurants and food chains etc. have also found favour and will continue to rally forth given how much price erosion has happened there.

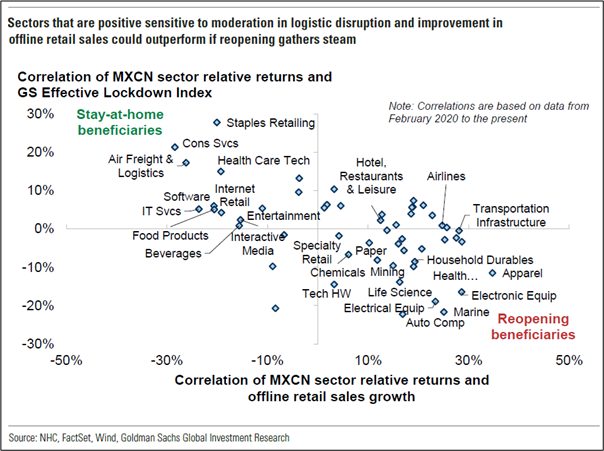

Over time, the more industrial parts of the economy which too had been running at sub-optimal levels of activity could begin to see a recovery in demand from the economy and see growth returning in the latter half of the year. Finally, the problem sector of the last two years – property development and management services – offers high-beta trades for investors with good risk appetites. Here, an alleviation of the risk to companies’ survival could lift share prices substantially higher. Another similar sector where reopening could be a delayed event but where stocks have been badly hit is the casino sector. Companies’ balance sheets look a lot different today than they did pre-pandemic, hence selectivity here is required. The accompanying chart is a good matrix to identify sectors which stand to benefit the most and the least from the reopening of China.

Yet, The Path To Liftoff Could Be Rocky

While we have had a strong rally in some of these sectors thus far and a certain optimism has returned to the market, there is a large swathe of investors which remains unconvinced and wishes to see more evidence of action on the ground. We should also note that over the next few months, the way China reopens will indeed be rocky and fraught with some missteps, possible delays, etc. There is every likelihood of case numbers rising first as China relaxes mobility measures. This could spook investors yet again and surely impart volatility to stock prices in this period.

Stock Market View And Potential Returns

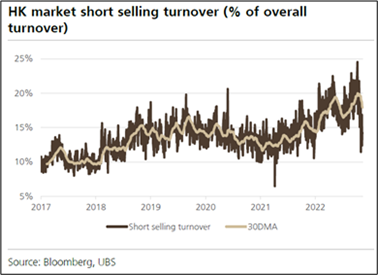

HK-listed stocks have been heavily sold-off, especially in the second half of 2022. Investor positioning has been light and stocks have been heavily shorted (see the charts below).

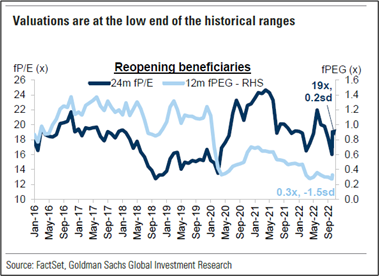

Forward P/Es are at multi-year lows, running below -2 SDs at the trough in October. The recent rally has only marginally corrected that situation. Several stocks appear to have rallied in large percentage terms off those low readings, but in the context of their outsized declines from the 2021 highs, most names have recovered just a fraction of their declines yet.

The extent to which valuations have been depressed can be seen from the MSCI China chart which reflects the forward P/E in 2022 to have been further lower than the P/E when the outbreak of Covid was first reported in 2020.

We expect that, should the reopening of China play out substantially as per script, stocks could continue to rally broadly in the next few months. The normalisation of the excessively high risk premia associated with China’s zero-Covid policy lockdowns and the return of foreign capital flows into the market ought to lead to 2023 witnessing a full-blown rally where the MSCI China and HSI indices rise a further 15-20 percent from where we stand currently, but not before we are made to endure some volatility along the way.

Given the wide swathe of deep value that lies abegging in the HK market, it would pay to take not just a short-term myopic view of buying reopening plays here. Rather, this might be the opportunity to buy into businesses where the underlying growth model remains robust and unchanged and where short-term profits have been impacted mostly due to forced lockdowns and global factors.

We sense anecdotally and empirically that much scepticism remains yet among investors, despite the recent rally in stocks. Clearly, the authorities’ next few acts are being watched very closely. Foreign investment flows will likely return in a big way but only when palpable change in policy and action on the ground are visible. But as we know, the price of certainty can be quite high!

Now may well be the time to prepare for the lift-off that is most likely coming in 2023, more likely earlier than later if recent actions and utterances are any indication. Stock markets tend to be quick to price such turns in events well ahead in time. To conclude, going into 2023, China’s economic liftoff and return to normalcy could be the key investment opportunities of 2023 and beyond. As we prepare for the holiday season, it is with the hope that a China that is fully reopen for business augurs happy tidings for the world.

On that happy note, I hear the low basal mellifluous tones of singer Tunde Baiyewu from the 90s band Lighthouse Family waft in through my door as I prepare to end this monthly, in a song very appropriately called “Lifted”.

‘Cause we could be lifted, lifted, lifted

We could be lifted

From the shadows, lifted

Oh, we could be, lifted up today…

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.