In our past write ups we have introduced investors to the concept that while China goes through its structural macroeconomic adjustment phase, there are newer and exciting opportunities emerging in Tertiary sectors which throw up interesting investment opportunities, we called it “The other China no one talks about”.

In this piece we are looking at trends in the Consumer space, where we are actively invested.

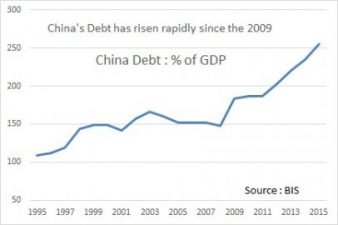

To recap, China is going through a Macroeconomic adjustment phase, as it transitions to a lower growth, Middle Income economy. This adjustment is complicated by the socio-economic structure and the past growth model which was heavily Investment driven and which in the recent past depended on taking on more and more debt to produce diminishing rate of incremental output. Consequently, we are now faced with a Debt overhang which is going to weigh heavily on Investment activity and future growth. On this parameter, China seems a lot like the Western world where we are seeing growth struggle due to leverage overhang, as elaborated by us in “Macro Thesis underpinning our Investment Views”.

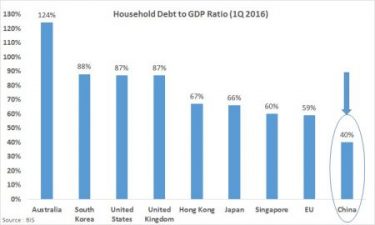

While China goes through its deleveraging cycle, there is a segment of the economy where leverage is low in absolute terms as well as relative to the world, The Chinese Consumer.

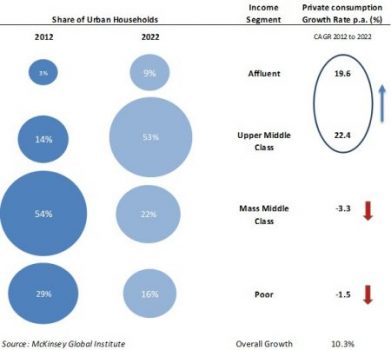

In addition to being underleveraged the profile of chinese consumer is changing. The chart below shows the rising proportion of Upper middle class and Affluent consumers in China, who are driving growth at the top end of the consumption pie at a faster pace.

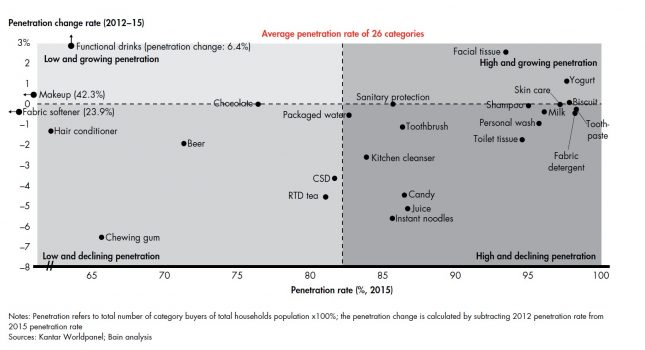

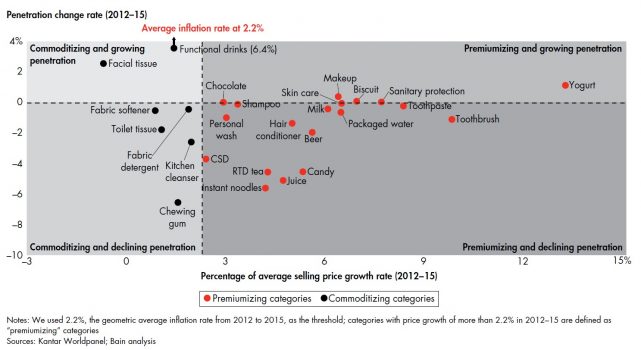

As China moved from a closed economy to one an open one, the last 20 years had been a story of penetration. As penetration reaches saturation levels, closer to developed markets, the growth story is likely to shift towards satisfying the aspirational customer who is looking to upgrade.

Chart 4 (Below) : Consumer Categories in China are reaching saturation with plateauing penetration.

Chart 5 (Below): as penetration saturates, categories which are premiumizing are seeing growth.

So what we have in China is an underlevered, aspiring consumer who is already upgrading. From experiencing new categories for the first time, driving penetration, the story has now shifted to the new consumer, who is ready to spend more to experience premium products and services.

What does it mean for Investors ? Consumer companies which have a premiumization strategy or selling to the aspiring consumer have a business model which can continue to deliver growth.

Our investment strategy in China is to find companies which have a business strategy which are targeting this changing trend in China, which can deliver high single digit growth and are generating excess free cash flow which can be paid back as dividends or used to acquire complementary businesses in the home market or overseas to satisfy the needs of the new China.

When we analyze recent trends in Consumer space, what stands out is the surprisingly poor performance shown by a lot of Staples, companies selling day to day categories like Noodles, Beverages. In the 1st Half of 2016, many of them reported double digit volume decline, unusual for an Emerging Market. The key reason for that is high penetration and lack of differentiation in their product strategies.

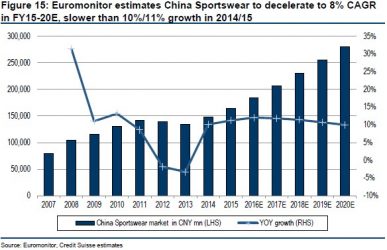

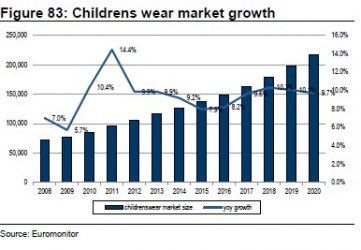

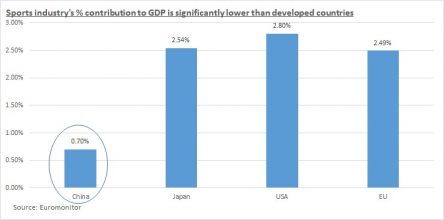

On the other hand we have been drawn to the Sportswear & Apparel segment, where rising incomes and middle class aspiration towards a quality, healthy lifestyle is helping the innovative players to build strong brands and robust business models. They have & we expect them to deliver consistent growth while generating stable cashflows. These companies have good dividend yields, keep rewarding shareholders with special payouts and have capacity to drive growth by capitalizing on both organic and inorganic opportunities.

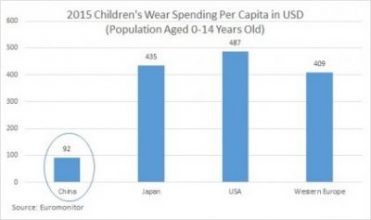

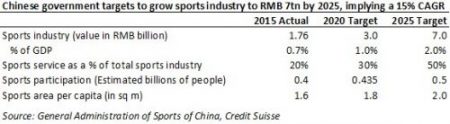

Sportswear market is forecast to decelerate to 8% while Children’s wear continues robust growth at 10% CAGR from FY15-20

Growth in sports and children’s apparel is being driven by Chinese consumers catching up with Western world in terms of lifestyle.

Government policies are encouraging these industries while Organized players with strong brands reap the benefits.

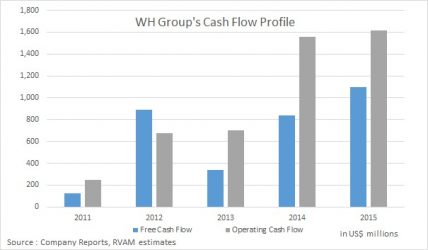

We have been highlighting an emerging theme in Asia for sometime, as growth slows, Capex requirements for businesses reduce and the focus shifts towards managing cashflows.

One of our strongest ideas in the consumer space in China, which nicely fits our thesis, is surprisingly in the Staples space, where lots of companies are reporting poor numbers. It is one of the world’s largest pork manufacturer’s in the world. More details in the box below :-

W.H. Group (WHG, 288.HK) is the largest pork and packaged meat processing company in the world. The company has grown over time by consolidating in its home market China and becoming vertically integrated across global locations through its acquisition of Smithfield in the USA. It now controls the entire pork production and marketing chain, from raring hogs to selling branded processed and packaged meat in the U.S. and China. It does this by having world scale manufacturing operations, established portfolio of brands and a large global distribution network.

The company listed in HK Exchange in 2014 and since then has reported steady and growing revenues and profits, regardless of the vagaries of the Hog market or pork price volatility due to its integration across the total value chain. The business has low capital intensity, generates growing free cash flow, which thus far has been used to reinvest in the business and to pay down debt. As a result, it could be in an enviable situation of being almost debt-free about three years from now. WHG is a typical example of a company that’s benefitting from the premiumisation trend in a fully penetrated industry (pork), as it introduces branded packaged products from its stable in US to its customer base in China, opening up new growth avenues.

For a company with such attributes (now a Fortune 500 company) and an integrated model that smoothens the volatility of the earnings and cashflows, its stock trades at extremely undemanding valuations in our view. It has been one of our strongest ideas for a few years now. We like it for the steady earnings growth and the free cash flow it will generate over the next few years. The FCF yield of 8.5% on a 1-year forward basis is particularly appealing. It wouldn’t surprise us at all if this stock were to re-rate upwards to reflect the true strength of the business, from its current year estimated Price to Earnings (P/E) ratio of 12.6x.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.