All investments involve some degree of risk. In finance, risk refers to the degree of uncertainty and/or potential financial loss inherent in an investment decision. When making decisions we evaluate a variety of risks – business, economic, volatility, etc. Among them, regulatory risk is always one of the most difficult ones to get a grip on across countries. Regulatory risks, which many times come out of sharp changes in government policy, are often unforeseen or least expected. Such risks often include seemingly irrationally high and unexpected doses of taxation. Investors get blindsided, wondering how they could have missed handicapping such an event when building their investment case.

The outcome of such actions often precipitates a violent reaction in the stock price of companies directly impacted, giving investors no time to respond or react when the first stab of price action happens. These are the proverbial “bolts from the blue” that knock the stuffing out of stock prices for quite some time before some recover their poise, while many don’t for years. We experienced one such instance of a bolt that struck early in November, this time emanating from Malaysia, which inspires our piece this month.

Malaysian Budget Bolts

As markets were closing on Friday the 2nd of November, the Malaysian Finance Minister Lim Guan Eng rose in parliament to present the first budget of the new administration. The market expectation was for a tough budget with marginal rise in taxes across the board, given the government desire to right size Malaysia’s fiscal position. The papers were tabled and markets closed listening to the speech which seemed in line with expectations. However as the details came out, shareholders of quite a few companies went home that Friday evening nursing a severe headache as the budget struck a blow.

One of these companies was Genting Malaysia Bhd, which is investing significantly in its facilities in the highlands to make them more attractive for tourism, a purpose that was in line with the government’s objective of making Malaysia an attractive tourist destination. News soon filtered through that the finance minister had proposed a 10% increase in gaming tax (from 25% to 35% for the mass segment and 10% to 20% for VIP gamblers) which knocks 30% off Genting Malaysia’s EBITDA in one shot. The market was expecting some increase but not of the magnitude it got. Effectively the tax hike has robbed shareholders of one year’s earnings growth. The stock price got slammed Monday morning by over 20% as a raft of earnings cuts followed, as analysts adjusted numbers to the new reality.

Investors in another company, Malaysian Airports (MAHB), came away scratching their heads after reading that the government was planning to create an Airport REIT, the first of its kind in the world. This at a time when the Regulated Asset Base (RAB) and user fees structure are under intense debate and negotiation. While it may all turn out well for MAHB eventually, the stock becomes nearly uninvestable until these negotiations and new structures are decided, given the huge uncertainty surrounding these two events. The stock price was hit by 10% Monday morning but has recovered somewhat since. For an entity operating in a regulated business, investors are attuned to changes in parameters, but when new regulatory paradigms (like the REIT here) are thrown up from nowhere, the meaning of ‘regulatory uncertainty’ reaches a new plane.

High Flying Indian Asset Managers

The last few years have been a very profitable period for one segment of the financial industry in India – the asset management companies (AMCs) which manage a plethora of mutual funds. Strong economic growth with a rising middle class and higher savings combined with the trend of increasing financialization of savings (away from real estate and gold) meant that the industry grew at a CAGR of 25% over FY15-18. The most profitable segment – equity mutual funds – doubled in size over two years and over the period FY15-18 grew at a CAGR of 35%. With strong profitability (super normal in some sense) and a rosy growth outlook, given structural under-penetration in a growing market, everybody wanted to be in on the action. No wonder we have a long list of AMC’s queuing up to list in the stock market and those that listed are traded at high multiples.

This rosy picture came crashing down on 18th September 2018 when the regulator, the Securities and Exchange Board of India (SEBI), announced the first major revision to the Total Expense Ratio (TER) slab structure for mutual funds since its introduction in 1996. SEBI’s view is that while the industry has grown manifold, the benefits of scale have not been shared with investors and that players in the industry were earning excessive returns.

There were two main regulatory changes made – one to the TER structure and the other to marketing commissions.

a) The erstwhile TER slab structure started at 2.5% base TER on the first Rs.1bn of AUM, moderating gradually to 1.75% on all AUM above Rs.7bn. This was revised down to now start at 2.25% and progressively decline all the way to 1.05% on all AUM above Rs.500bn.

b) The new rules require the mutual fund industry to adopt the full trail model of commission for all schemes, i.e. without payment of any upfront commission or upfronting of any trail commission. Also, all expenses and commissions would have to be paid directly from the scheme itself.

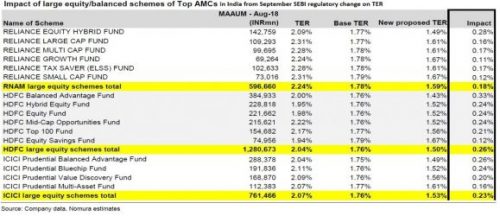

While it is difficult to arrive at an industry aggregate impact, the overall impact would be higher for AMCs with a higher equity mix. The impact in terms of costs is quite large, at an average of 0.23% on a base TER of 1.76%, an implied increase of 13% of revenues. The impact on a few of the schemes of large listed asset managers is shown in the table above.

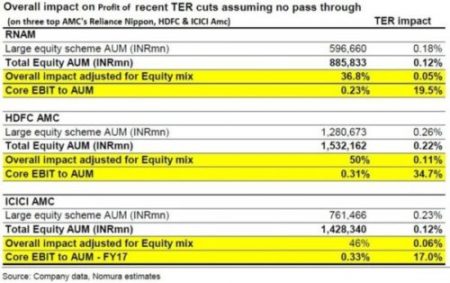

The impact on profit using latest reported numbers is shown in the table below.

The impact on profits given the large scale of these AMCs is obviously significant. Stocks promptly fell 20-30% post the announcement over the next few days as investors scrambled to reset their earnings expectations sharply lower in response to this SEBI diktat. Clearly this was a case of super normal profits (ROE’s of 25-40%) attracting the attention of the regulator, who acted in the best interest of the average retail investors to the detriment of industry profitability.

Tencent’s Fall From Grace

Tencent is one of the best-liked and most widely-owned stocks of the past few years in most Asian portfolios. We had mentioned in our write-up of December 2017 “The Learning From Fallen Angels” the potential for regulatory risk in these private internet behemoths in China.

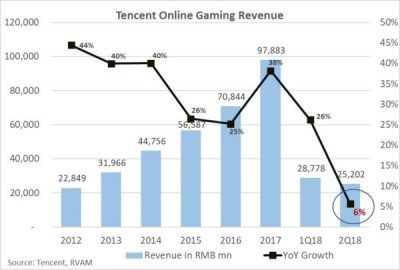

The largest revenue contributor for Tencent is its online gaming business. In 2017 it was nearly 40% of total sales and has grown at a CAGR of 34% over the five year period 2012-17. When we had mentioned regulatory risk in Tencent we did not know exactly where it would come from but given the supernormal profitability and the sensitivities in China, we suspected that the risks had gone up for the overall company. Also, with a very high starting valuation, the stock was susceptible to any negative news on this front.

The negative regulatory news came in April 2018 when the online gaming regulator announced a temporary suspension of new gaming licenses (online games need to be licensed in China). The cause of this change was a restructuring of government divisions/ regulators from the existing 27 to 19. This led to confusion about who has regulatory power over this industry. Also, there was a slowing down of all decision making while this restructuring was being implemented. Initially this was expected to be a temporary problem but a second blow on this same front came in August when President Xi Jinping made a call for a coordinated effort by various government agencies to tackle increasing cases of myopia amongst Chinese students. Soon enough one of the online gaming regulators announced that it would limit the number of new online games to be released and would take measures to restrict time spent by minors on playing online games.

Instantly Tencent’s gaming revenue dropped from 34% CAGR over 2012-17 and 26% yoy growth in Q1 2018 to only 6% in Q2 2018. This was disastrous for a stock which in Dec 2017 was trading at a P/E of 40x (12m forward earnings) with high growth expectation. This partly explains the 30% drop in Tencent’s price this year.

The last two examples were of well-run businesses in industries which were generating high profitability, which were rewarded with high valuation multiples by investors making these stocks especially vulnerable to unexpected regulatory changes.

Rusal, Trump and the Uncertainty on Aluminium

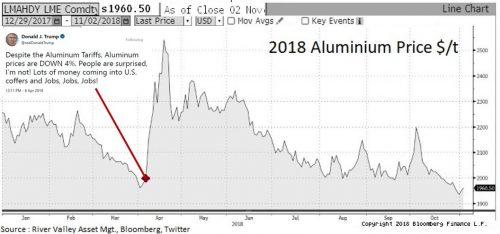

Two years into the Trump presidency the market is attuned to cryptic market moving tweets emanating from the White House, but even by those standards what happened in early April this year is noteworthy as the repercussions are still not clear. One Friday, late evening after markets had shut in Asia, there was a gloating tweet emanating from that most watched twitter feed vaunting the success of US tariffs on aluminium, how they had brought prices down by 4% with lots of jobs to follow. A few hours down the line, the US Treasury announced sanctions targeting Russian oligarchs and businesses linked to them. One of them was Oleg Deripaska, controlling shareholder of Hong Kong listed company Rusal, the largest aluminium producer in the world. The weekend turned into a nightmare for lots of unconnected people all around the world, keeping bankers, lawyers and corporate executives awake trying to figure out the consequences, which six months down the road are still nebulous.

The chart on the left captures the impeccable timing of that tweet, with aluminium prices rising 25% in subsequent days (small change compared to Trump’s -4% gloat) as the full impact of the announced sanctions dawned on the world. Rusal accounts for 6% of global production of aluminium, a metal which in modern society is as omnipresent as steel, whether as lightweight frames in aeroplanes and fuel-efficient automobiles or in day-to-day usage for kitchen wrapping and beverage cans. Even the US administration took a few weeks to get to grips with the real world implications. Over subsequent months we have seen a series of exemptions and extended deadlines to comply with sanctions. As we approach the next deadline (12th November), aluminium prices are back where they were before the saga started, with market participants nervously hoping there is no new curveball risk lurking around the corner.

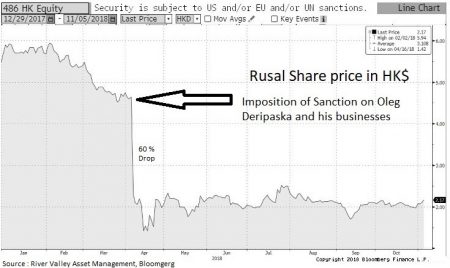

The chart on the right captures the dramatic move we have seen in Rusal’s share price, which used to move in tandem with aluminium prices, but when sanctions were announced saw a collapse of 60% and continues to languish (despite being cheap) as it is uninvestable for many investors due to the risk of falling foul of the long arm of US law enforcement.

While Rusal is easily ignored, other companies operating in the aluminium industry as well as the innumerable number of companies which use aluminium as a raw material are left wondering whether six months on another regulatory bolt from the blue will come and disrupt their business models, whether the price that they see in the market is real or the next missive from Washington will again disrupt the market equilibrium.

Lessons for Investors

While we could talk of numerous examples of how sudden regulatory lurches leave investors reeling, the key learning for an investor is how to protect capital from the impact of these unquantifiable risks without compromising on the return generation potential of investment ideas. At RVAM, we focus on having a disciplined process for investing and ensuring there is sufficient diversification to ensure that portfolios can sustain temporary impacts from such unforeseen bolts.

a) Disciplined Process: Our 5P/2P investment process focuses on identifying multiple (at least five) fundamental parameters which anchor the rationale for owning a position in the portfolio. Changes to more than one parameter make us re-evaluate the robustness of the investment thesis and take action. In addition we have two valuation-driven price bounds within which we would be comfortable taking a position. The bigger the upside to our upper (sell) bound, the greater the cushion we have to handle price swings brought about by extraneous factors.

b) Diversification: In portfolio theory this phrase sums up the concept of diversification – “don’t put all your eggs in one basket”. However, in practical terms the idea is to build a portfolio that has multiple sources of return and does not chase just one theme or idea; this strategy would prevent significant drawdown on capital when faced with a bolt from the blue. We place limits on maximum ownership in a single company, however good the idea be, as well as limits on sectors and countries, so that sudden lurches in policies in any one area have a limited impact on the overall portfolio return.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.