Not many years remain indelibly imprinted in memory in financial markets. But some stand out and become milestones in its history. The year 2014 will be one such year that will have more than one significant marker. They could be “crude oil prices collapsed”, “the dollar rally began”, “the Rouble collapse”, “the Yen was driven down”….and possibly more.

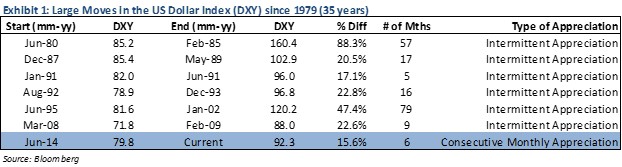

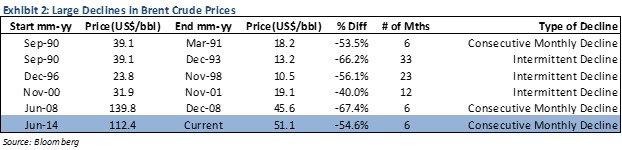

Seldom do so many things come together as they did in 2014 in such a significant fashion and in such a short period of time. Now that 2014 is behind us, it has given investors in 2015 plenty to think about. The size of the shifts in prices of the US Dollar, Crude Oil and Bond Yields are truly among the most significant we have seen in the past 30 years or so. Such big moves in currencies, commodities and treasury yields in a matter of months are not usual financial market phenomena. Any currency move which is greater than 10%, whether completed in consecutive months or intermittently over a period of time in either direction, ought to be construed as a ‘big move’. To limit the discussion, we have highlighted only ‘USD appreciations’ that meet the criteria. Take a look at Exhibits 1 and 2 to fathom the current phenomenon.

As the current strength of the US Dollar against global currencies and the decline of crude oil prices are still ongoing, this period could be the first consecutive monthly strengthening of the US Dollar as reflected by the Dollar Index (DXY) in the last 35 years. Similarly this has been only the second episode of six consecutive monthly declines in crude oil prices since March 1991, the other previous one being the one that followed the global financial crisis in 2008.

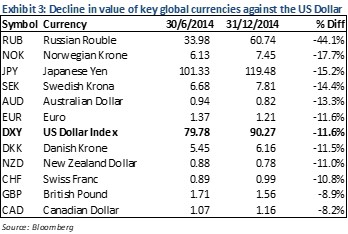

Beyond the mere statistical, the sheer magnitude of the declines in the value of the currencies of developed countries is quite staggering (see Exhibit 3). It is not surprising to find resource-rich countries (Australia, Canada and Nordic Countries) whose currencies have been most impacted by the decline in crude oil, natural gas and coal prices.

It must be remembered that every such large directional move in a currency or commodity tends to shake the foundations of the underlying drivers of this move. This tends to elicit a strong response that then leads to the trend reversing and going the other way. Of course all this could take months, often years to unfold.

The current strength in the greenback is possibly another prolonged spell of strength that could have direct and indirect economic impact on many parts of the world. The same can be said about the collapse in the price of crude oil. All this throws up an entirely new set of investible opportunities over the coming weeks and months as businesses grapple or rejoice at the turn of events.

We now suddenly find opportunities springing up in unlikely places and sectors. Countries such as India and Indonesia whose economies were reeling from poor fiscal management now find themselves rejoicing now that crude oil prices are at $50. The financial savings from their oil import bill could be used in myriad ways to fix their creaking infrastructure, healthcare, housing, power generation, etc.

Even within the developed world a country such as Japan, which received fewer tourists than tiny Singapore, could perhaps be unprepared for the gush of tourists who might land up on their shores post the Yen’s depreciation. Likewise Australia, New Zealand, Canada and even Europe are now cheaper holiday destinations than they were last year. It is not surprising then that airlines, hotels, tour operators are all fair game for the picking by investors in these geographies.

Competitiveness of several countries’ produce against others could be disrupted. Cost of capital would change dramatically for many in a beneficial way they could never have dreamed of. Governments will have to wake up to this as well. For some resource-rich nations these are hard times and it has reached crisis-like proportions for Russia, whereas for India it has been fortunate. How both countries respond to the current situation will determine their prospects for the next ten years.

The US itself will throw up an entirely new set of winners and losers from this turn of events. It is certain that large parts of the US economy will begin hurting from the strong dollar soon. This is likely to reflect in poorer GDP growth and corporate performance later in the year, much against current thinking. Will that lead to rethink on the future trajectory of interest rates set by the Fed? Will the roaring stock market finally have a long pause after a six year inexorable bull run? Will near deflationary conditions force the European Central Bank to ‘do all it takes’ to yank Europe out of the rut? How will perfectly solid Nordic countries react after seeing their currencies bludgeoned by 12-18% to the US Dollar all in a matter of a few months? And, what does a yield of below 2% for the US 10-year government bond and 0.5% for the 10-year German Bund tell us about growth in the medium term in these economies? For those reading the tea leaves, the investing world will start looking a lot different a few months/ years hence.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.