Back in the nineties when I was a callow analyst in Mumbai, a veteran investor once told me that to make money in cement stocks, all one needed to track and know is the price of a 20 kg sack of cement. The rest would follow from that. This was true for a long time while India remained shut out from the rest of the world. The industry’s structure changed irreversibly once Dr Manmohan Singh, the then Finance Minister, threw the old socialist rule book into the Indian Ocean.

Back then, oversupply was not a concern and the industry was fragmented yet, oddly, cartelized. Over time, the industry has become a truly three dimensional one in India where volume and raw material costs began to determine industry profitability in addition to price and, by extension, stock performance.

Cement Capacity: The Millstone Around the Industry’s Neck

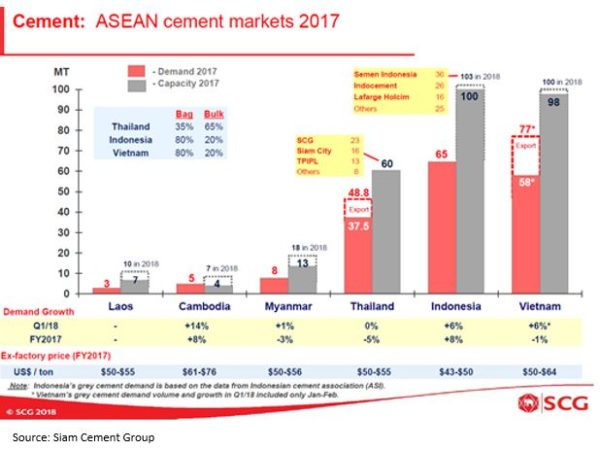

The cement and building materials industry in Asia, more particularly in ASEAN, has seen dramatic additions in capacity over the last decade. Capacity additions have seldom been smooth or orderly in any country.

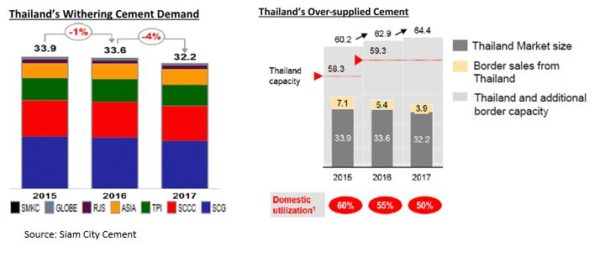

Thailand was the first to ‘overbuild’ and where the overcapacity is so huge that it has not been able to work it away for years despite exporting much of it. Malaysia suffers from excess capacity but does not export much of its cement and hence company level profitability is poor. Given the small size and limited investable options, it is the least discussed in the region. Vietnam, Laos and Cambodia are also markets where capacities have come up well ahead of economic development. This has led to surpluses being exported around the region, willy-nilly disturbing the balance in the region further. Vietnam is a big market as well, where the overkill can be seen in the chart alongside.

A Thailand redux, if you may. But it is Indonesia which is the largest of all ASEAN markets for cement and where capacity growth has surged in the current decade. It is also where a couple of listed stocks have depth and liquidity and are of most interest to investors.

The earlier slide from a recent Siam Cement presentation illustrates the overcapacity in ASEAN. Clearly, this does not make for happy reading as an investor.

The overcapacity that dogs the industry in every country has its roots in the over-optimistic growth assumptions made in previous years. Such assumptions have continued to be made as recently as at the end of the Global Financial Crisis and early in the current decade. While growth has picked up in this region since 2009, it has not accelerated enough to lap up this capacity. More importantly, the huge infrastructure spends that were supposed to follow have disappointed by a long way. In country after country, the narrative on infrastructure reads the same. Grandiose government plans have come to grief thanks to weak regulatory frameworks for bidding and awarding projects, lack or shortage of funding, resistance to government acquisition of land, among other things. In countries such as Indonesia and The Philippines, there is more committed capacity which will come into production before the industry can catch its breath.

Weak Prices: Learning to Live With Them

Overcapacity has led to weak prices across the region. The weakness in each country has been impacted by one or more factors germane to them. While demand growth has sustained in the mid to high single digits, the sheer growth in the number of new players in many markets has meant that pricing discipline has been sacrificed at the altar of volumes.

In Indonesia and The Philippines where ASP data is more readily available, prices of cement have been on a slide for two years or more. The silver lining is that they have been seen to be stabilising in recent months. Industry sources believe that prices have perhaps hit rock bottom and that some of the new capacity may struggle to stay afloat.

But it is now a given that unless capacity utilisation levels rise to the mid-70 or above 80% in Indonesia, prices are unlikely to strengthen by much. Any price bounce engineered by desperate industry players could be capped till then.

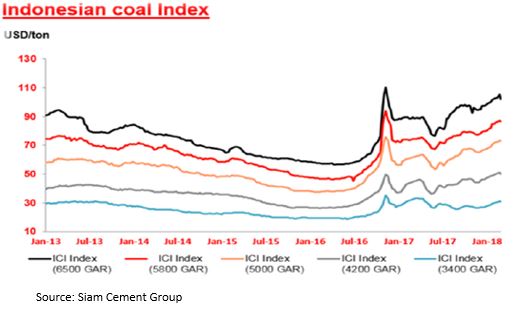

Coal Prices: Nobody’s Friend

As if the twin blows of overcapacity and weak demand were not enough, coal prices have been rallying hard for over a year now. While coal’s own dynamics are beyond the scope of this piece, it suffices to say that this is a massive headache for the cement industry. Coal is an important fuel in this energy-intensive industry (power and fuel account for 20-30% of sales depending on the fuel mix).

Profitability of the industry has thus been badly impacted by coal prices (which are now holding fast above $100/ton versus lows of $50/ton back in 2015-16). There is no sign yet that coal prices are peaking or likely to reverse soon. Any optimism on abating industry costs must be put on hold until there is evidence that coal prices have reversed decisively.

Below we discuss briefly the situation as it exists in each country.

The Philippines: The industry’s overcapacity problems do not look as monumental as those of its neighbours. Total industry capacity is expected to reach 45mn tons by 2020E versus the 28mn ton capacity at the end of 2015. Demand is expected to grow at an average of 6-7% p.a. in this period from 24.4mn tons to 33-34mn tons. While utilisation levels in the industry are much healthier than anywhere else, averaging 75% or so, it is the huge pressure from cement imports from Vietnam at an average wholesale price of $100/ton which has broken the back of the industry.

Given Vietnam’s huge production surplus, it is unlikely that its exports are likely to subside or withdraw anytime soon. As such the Philippine industry’s recent 5% price hike taken earlier in the year may be a rare show of solidarity but which may be difficult to repeat anytime soon until perhaps demand accelerates. The weak Philippines Peso has further added to the industry’s cost woes.

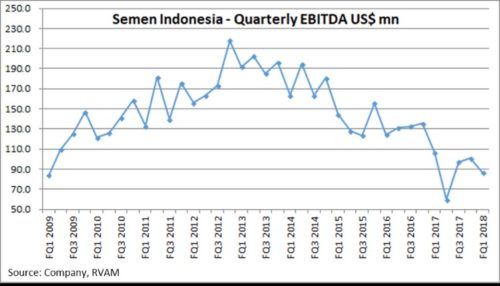

Indonesia: Indonesia’s cement industry was the ‘freak’ of the region around the turn of the last decade and much after. I remember analysts and investors buying cement stocks at multiples that would make consumer staples companies blush! They insisted that cement companies’ brands and pricing power gave them FMCG-like status! It appeared for a while that such conclusions were quite correct. But like all good things, such trends never last forever. This invited foreign competition to its shores as well as a slew of local businessmen keen to get abroad the gravy train.

From an industry where cement seemed to be rationed out by chiefly three companies, it has become a slugfest of a dozen or more players battling for market share, including well-muscled foreigners like Anhui Conch and Siam Cement in the fray. Nowhere is this skirmish more intense than on the island of Java where two–thirds of the country’s capacity resides.

Cement prices have trended just one way since then: down. Prices have held steady since the start of the year. There is chatter that an uneasy truce has been called and that industry leaders are trying to muster courage for a price hike soon. It has taken longer to arrive, but could yet, if the industry can summon disciplined behaviour from the new entrants.

The industry has another bugbear (other than overcapacity) in the form of coal prices. Given that coal is priced in US Dollars and that the Indonesian Rupiah is among the most skittish of currencies in Emerging Markets, the current swoon against the greenback has come to hurt the industry further. As a result, industry leaders Semen Indonesia and Indocement have seen their EBIDTA margins plumb depths never seen nor imagined before. Semen Indonesia enjoyed FMCG-like margins of 30-35% between 2008-2014. This year it will be a near miracle if EBIDTA margins cross 20%. EBIDTA/ton at the end of March 2018 quarter was around $120/ton and is below ~$100/ton as we write.

Where do we go from here? Within the triumvirate of price-volume-cost, it appears that the only stable and dependable change is likely to be demand. Demand is clocking 6-7% currently, but if the government can get a move on on some large infra projects then this could pick up to 9-10% or more, closing the output gap faster and supporting prices. Prices could find support at current levels at the current rate of demand if the industry discipline holds and Anhui Conch, now a key player and a disciplined one, decides to nudge prices higher. It is a common refrain that the new capacity from the smaller players is now ‘working solely for the banks’.

Cement prices in Indonesia may have bottomed. Price could float higher driven by stable-to-better demand ahead of elections next year. The exchange rate appears to have moved a lot in one direction and some reversal or stability from here might stem the pressure on costs. Coal prices are a wild card to call in the medium term but given where they are, it is hard to make a case for them going much higher sustainably in the future. The profitability of the industry could then be possibly troughing this year. Stock prices may have possibly bottomed as they discount such events ahead of their arrival.

Thailand: It has been an interminable wait for recovery in demand for cement in Thailand. The last three years have in fact seen demand drift lower and analysts are calling a further decline this year. Given the policy making uncertainties that prevail, much of Thailand’s grandiose rhetoric has seldom been translated into action. Of the top two players, Siam City Cement, a pure play on ASEAN cement, is perhaps the best proxy to the region. Investors would perhaps warm up only if they see Thailand’s own market demand improve.

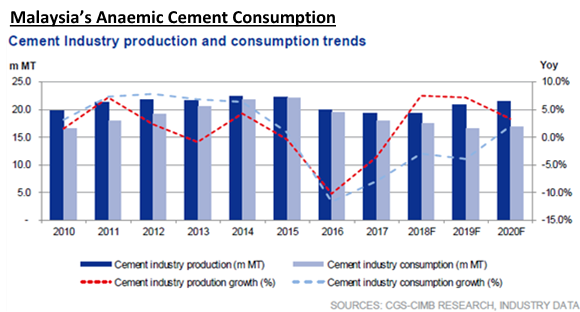

Malaysia: Malaysia too has seen capacity build out in anticipation of large scale projects being rolled-out by the government. Alas, now with a more fiscally pragmatic change of guard, several projects are up for renegotiation and some might be simply binned. This will knock off a large chunk of potential demand that the industry was hopeful about. Malaysia’s cement capacity at the end of CY17 was ~34.5mn tons as per a CIMB Securities report. Against this, consumption has been declining for the last two years, 8% in 2017 and 6% in 2016. This year analysts are forecasting a further decline by 3-5%. Clearly, Malaysia’s cement industry has to see a huge reversal of demand from infrastructure projects, barring which organic private sector demand from property etc. is unlikely to lift it from the dumps.

Others: Some charts of key markets such as Cambodia and Vietnam portray a similar picture of overcapacity and pain. Crucially, these countries by being export-oriented end up depressing prices of cement in recipient countries further as we have seen in The Philippines.

Investment Options

While ASEAN has a quite a few listed cement companies, given the overcapacity situation prevailing currently, most investors are likely to be put off and adopt a wait-and-watch stance.

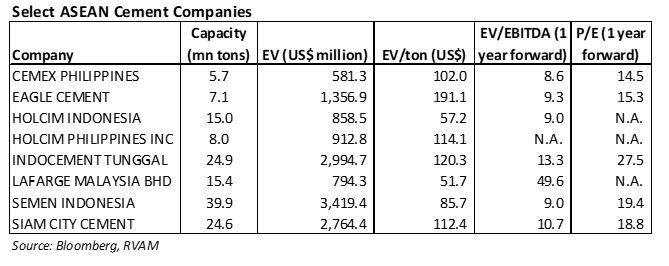

When industry profitability is at rock-bottom levels, conventional valuation ratios such as P/E often do not help. Given that the industry is a long-cycle one, past experience shows that investors use different metrics at different stages of the cycle.

A good indicator of an industry at stress is to check how far below the replacement cost listed assets are trading at, measured using their EV/ton and comparing against a greenfield replacement cost on a per ton basis. As the industry profitability picks up, investors either assign higher EV/EBIDTA multiples to stocks or combine it with P/E as growth visibility becomes palpable, jettisoning EV/ton as a metric.

Another strong indication of an industry in the throes of problems is significant consolidation and/or mergers and acquisition activity. There has been talk of some smaller players capitulating to the bigger ones, but we have not heard announcements yet.

The best investible options reside in Indonesia and The Philippines as per our analysis. Earnings downgrades have not run their course completely in our view, but they well might sooner than later. Currently, Semen Indonesia and Cemex Philippines trade at $85-90/ton on an EV/ton basis, while Indocement trades at a more charitable value of $120/ton and SCC in Thailand at ~$110-115/ton. Replacement cost is generally believed to rest between $120-150/ ton depending on country, scope and financing of a greenfield project anywhere in the region.

The pressure points for the cement stocks are well understood by investors today. A reversal in one or more of the three critical variables (price-volume-costs) will potentially nail a floor to their stock prices. This could happen in the short to medium term. The key then is to track these closely in what is now a much unloved sector, but where asset values are looking cheap selectively in absolute and relative terms for the first time in a more than a decade.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.