Anniversaries are good milestones to take stock, reflect and ruminate over the lessons. In the investing world, major events bring learning and at the same time throw up new opportunities. The Asian Financial Crisis was one such event where many myths were shattered, fortunes lost and then made by the very few who were brave and liquid.

The early 90’s was a gung-ho period in the Asian investing world with the fast-growing East Asian miracle economies attracting more than half the capital flowing into developing countries, encouraged by global institutions like the World Bank which lauded their market-friendly economic policies. With open capital accounts, strong GDP growth and low inflation, underpinned by hard working and growing workforces, these economies could do nothing wrong. The financial markets rewarded this dynamism with lofty and forgiving valuations. The narrative was very badly punctured when the Thai Bhat devalued on July 2, 1997, heralding the start of the Asian Financial Crisis, an event that not only set some of the Asian economies back quite a bit but also brought about profound social and political changes.

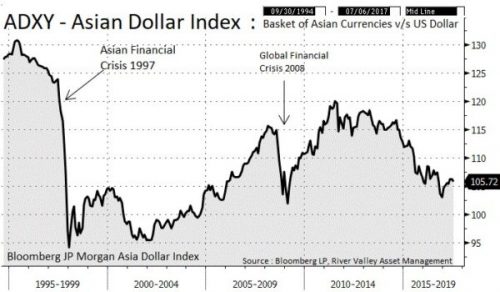

One of the key shocks leading to the Asian Financial Crisis was the collapse of Asian currencies. The chart below encapsulates the dramatic fall of ADXY, the basket of Asian currencies in the summer of 1997. What is striking is that twenty years on from devaluation of the Thai Baht in July 1997, we are still at levels which are lower than the early 90’s, the heydays of the economic miracle. The Asian currencies as a basket were overvalued, pushed up by capital inflows and kept at artificially stable levels to support growth through imported capital.

While initially it was easy to blame speculators and the collapse of currencies as the reason for the financial meltdown, the root cause was growth fuelled by taking on unsustainably high levels of debt at the micro level and rising current account deficits in countries at the macro level. This had to be supported by capital inflows, forcing policy makers to adopt a policy of managing the currencies.

The Adjustment Years

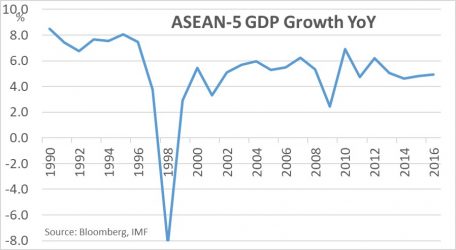

In the early 90’s, the Asean-5 (Singapore, Thailand, Malaysia, Indonesia and the Philippines) were the poster children of open markets and capitalist growth driven by investment. The Asian crisis was a shock to more than two decades of rapid growth for these economies, in varying degrees. Each of them went through different adjustment phases politically and economically and settled down to a lower phase of growth in the subsequent years. Growth in these economies over the last fifteen years has averaged about 5%, lower than the 7-10% they were clocking prior to the crisis. While growth rates have slowed, fundamentally these economies are in a better shape now and potentially poised for the next leg of higher growth led by investments (as we postulate later in this piece).

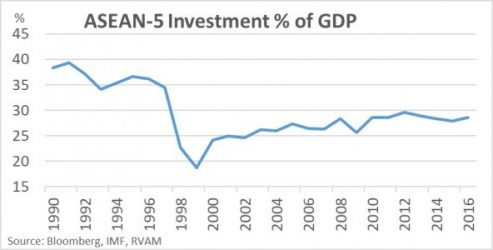

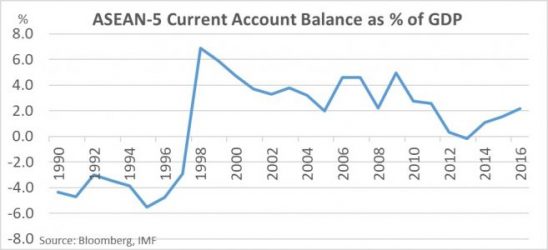

The first chart below shows how investment, which was a significant driver of GDP growth in the early 90’s, after collapsing in the aftermath of the Asian crisis, has recovered moderately and is trending at a steady pace for most of the recent past. Current Accounts, which were a weak link going into the Asian crisis, have since been running at a surplus (shown in the second graph) and countries have used this to build up significant foreign exchange reserves, a harsh lesson learnt from the forex crisis.

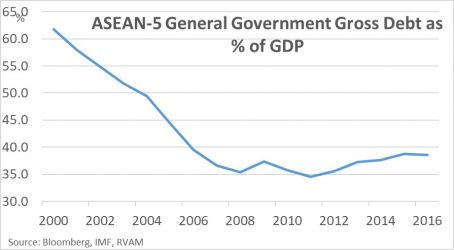

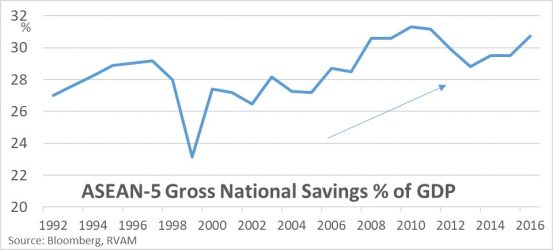

With moderate growth and a significantly improved external situation, ASEAN has also gone through a significant de-leveraging phase with public sector debt as a percentage of GDP (first graph below) falling to low levels. While the vulnerabilities have reduced significantly, these economies have not given up on one of their core strengths – the robust savings rate. Savings as a proportion of GDP, after taking a modest hit during the crisis years, has now climbed to levels which are higher than what drove the phase of rapid growth in the pre-crisis era of 80’s and 90’s. With strong economic fundamentals, we think ASEAN economies are ideally poised to accelerate investments and growth back toward levels which earned them the moniker of “Asian Tigers” in a bygone era.

The Impending ASEAN Investment boom

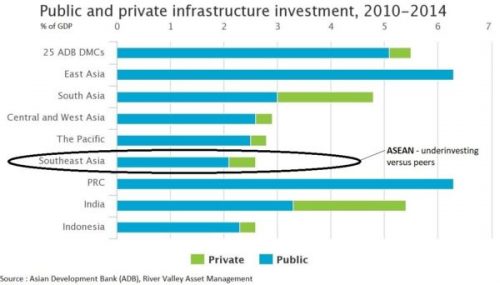

Over the last few months we have been attending conferences and listening to policy makers from different economies and what strikes us is the uniform focus of officials across different ASEAN economies on kick starting a new phase of investment-led growth. What is driving this is the underinvestment ASEAN has seen over the last decade in infrastructure as compared to the level of activity which has gone on in other Asian economies like China or India. The following chart from the Asian Development Bank (ADB) compares infrastructure investment across Asia as a percentage of GDP. As per ADB estimates, ASEAN needs to accelerate infrastructure investments to 4-5% of GDP to catch up with pent up demand, to ameliorate bottlenecks in their economies and improve the standard of living of their residents. 2-3% pick up in infrastructure investments (as % of GDP) can potentially take GDP growth rates in these economies back up to the 7-8% levels seen in the heydays.

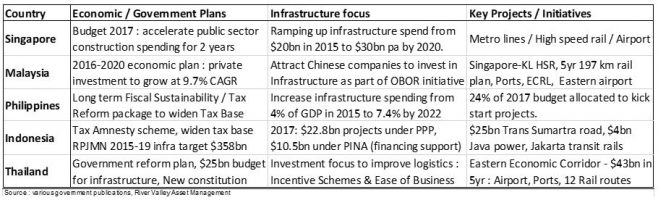

With low public debt and ample domestic savings, financing acceleration in infrastructure investment is not an economic challenge. Policy makers need to be geared up for it and from that perspective, across Asean countries, investment in infrastructure is increasingly looked at as a means to grow out of the cyclical slump brought on by falling commodity prices over the last few years. We analysed government publications and statements and across board we see multiple new initiatives.

ASEAN and the emerging CLMV opportunity

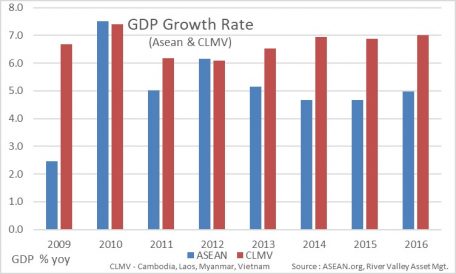

Talk of ASEAN invariably focusses on the large economies but the next decade of growth, unlike the past, is not just about the ASEAN-5 but also about opportunities being throw up in other ASEAN economies, which in the last cycle were struggling politically and ideologically with various economic challenges. CLMV (which refers to Cambodia, Laos, Myanmar and Vietnam) countries have been opening up their economy to investors. With a young and educated population they are increasingly taking on the role of the workshop of Asia with companies from Japan, Korea and Thailand setting up their factories and integrating them into the Asian supply chains. Celebrating 50 years of its inception in 2017, Asean finally seems to be at cusp of fulfilling the dreams of its founders.

As more mature economies, the ASEAN-5 have seen cyclical ups and downs over the last decade but the CLMV have been maintaining their strong growth trajectory, coming from a low base. With the adoption of the Asean Economic Community (AEC) in December 2015, with its common market structure, the CLMV countries have been provided an opportunity to synchronize their policies and undergo structural transformation by closely integrating with more developed ASEAN-5 economies. And potentially, herein lies the beauty of the next decade of investing in ASEAN, a region of strong growth with a balanced mix of developed, developing and emerging economies.

The Markets

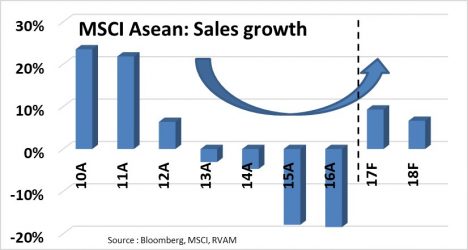

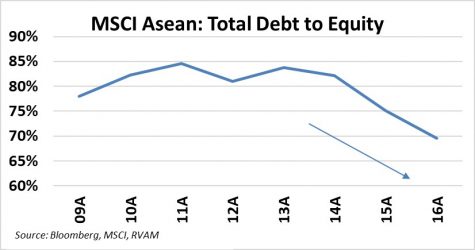

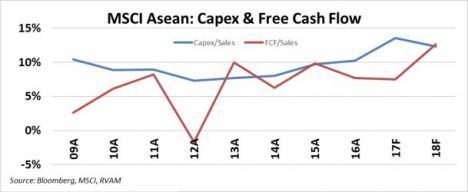

Having looked at the robust macro-economic background and strong growth potential in ASEAN economies, we now look at the investment opportunity in these markets. The publicly listed universe in Asean (as proxied by the MSCI Index) has a significant mix of cyclical businesses. After a few years of decline in sales we are starting to see a cyclical rebound in top line for companies listed in ASEAN (first graph below). While sales growth has been weak over the last few years, companies have used the period to reduce debt, improve cashflow generation and increase dividend payments. As growth returns, Asean balance sheets are robust enough to step up capital expenditure to participate in growth at the same time as continuing to reward shareholders through dividends. On valuation, MSCI Asean is trading at low end of its historic P/B range at 1.6x and on earnings at 16x.

The tried and tested route for investors to participate in economic growth acceleration in most emerging markets is by investing in local banks. In Asean there are a lot of well capitalized large banks with strong franchise and liquid balance sheets, making good returns on capital. Having gone through a deleveraging phase post the crisis, neither the economies nor the banking sector is overleveraged.

One of the companies which we have been interested in for a long time at RVAM is listed in Indonesia, operates in an under-penetrated sector, is a market leader, provides next generation infrastructure, has strong growth potential for the next five years, makes good return on investment, has low debt and while continuing to invest in its growth trajectory and rewards shareholders with dividends and share buyback. The company is called Linknet.

Linknet is a provider of high speed broadband and cable TV services and is listed on the Jakarta Stock Exchange (trades under Bloomberg ticker – LINK IJ). The company focusses on high end affluent subscribers and has first mover advantage in the key larger cities. Penetration rate for both its services are low in Indonesia – 11% for cable TV and 9% for broadband (comparative figures for Asia-Pac are 55% and 36% respectively). The company is part of an Indonesian conglomerate – Lippo Group – which has other related media business under the First Media brand.

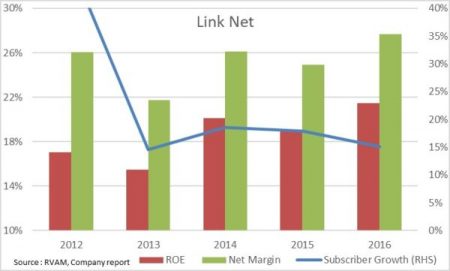

Despite first mover advantage, Linknet is not the largest and has competition from state owned PT Telkom. The company’s strategy is not to be the largest but to focus on the most profitable customer segment which is ready to pay for quality. This is visible in the margins they generate and return on equity which is close to 20%. Currently they have penetrated 38% of the target market in the top cities and over time will be looking to rollout to newer places. The company has a disciplined plan to invest and grow its customer base 15-20% p.a. and at the same time, given its profitability, generate significant free cashflow. The management’s policy is to pay out 35% of profits as dividends.

For a company with a strong market position and significant growth potential with steady earnings and cashflow generation, the stock is trading reasonably at 15.3x earnings and 7.3x EV/EBITDA.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.