Sometimes the most interesting ideas and investment opportunities emerge from activities and occurrences which are part of our daily lifestyle. Whether it is for work or recreation, many of us are spending more and more time stepping onto an airplane. However, despite the rising trend of air travel, airline companies have not been great investments. Low entry barriers leading to rising competition and limited differentiation as well as significant fixed costs have resulted in airlines struggling to generate adequate returns. But every trend has its winners, so within the eco-system of air travel we hunted for businesses that have higher entry barriers, steady demand, limited competition and attractive returns and were surprised by the robustness of our find – BOC Aviation (BOCA).

BOCA is a Singapore-based company, listed in Hong Kong, with a consistent track record of delivering revenue and earnings growth. It is run by a conservative management and benefits from exposure to a secular trend (growth in low cost carrier (LCC) travel in Asia). From a growth company trading cheaply and paying out an attractive dividend, BOCA is a stock with signs of a consistent compounder; it is an air travel play with wings and we think it is set to fly.

The Aircraft Leasing Industry

The global passenger airline industry is going through a secular growth phase driven by two key drivers – rising prosperity in emerging markets (which is increasing the pool of global airline travellers) and the emergence of low cost carriers in every corner of the world (which is expanding the pie by making travel more affordable). Playing this theme has been a challenge for investors as the obvious plays – airlines – have a poor track record of delivering value in the long run due to fragmentation of the market (786 airlines globally), serving a price-sensitive customer on the one end and facing high fixed costs and capital intensity on the other. Add to that the lack of control over the biggest input cost – volatile oil prices – and one can easily fathom why the industry has not been able to deliver consistent returns.

While passenger travel demand continues to exhibit secular growth trends, the historically low profitability of the airline industry has resulted in weak balance sheets, thus making it a struggle for players to find capital to grow their fleet size to capture the growth opportunity. This has provided space for aircraft leasing companies. Over the last few years more and more aircraft are being procured through leases with nearly 43% of the global feet currently being financed by operating lessors. Unlike the fragmented airline industry, the top ten lessors control about 70% of the leasing market.

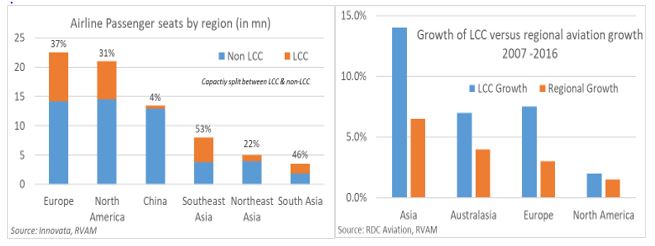

The rapid growth of LCCs has played into the strength of lessors as these players follow an asset-light strategy and look to third party sources for financing their aircraft needs. While Asia is the fastest growth market for the overall airline industry as well as LCCs, the share of LCCs (see graph above left) is not uniform across the region, thus providing additional penetration opportunities.

BOC Aviation

The company was founded in 1993 as a joint venture by Singapore Airlines and changed its name to BOC Aviation after it was acquired by Bank of China in 2006. Its business model has three key drivers:

a. purchasing new, fuel-efficient, in-demand single-aisle aeroplanes at competitive prices directly from aircraft manufacturers (leveraging on its scale and size);

b. cheaply financing those purchases and placing them on attractive long-term operating leases with a globally-diversified customer base, thereby generating a steady spread (margin); and

c. recycling capital by selling planes after they have established an operating track record, halfway into their lease term, at market prices, thereby locking in capital gains for shareholders and, at the same time, keeping its existing fleet

The Core Business Drivers

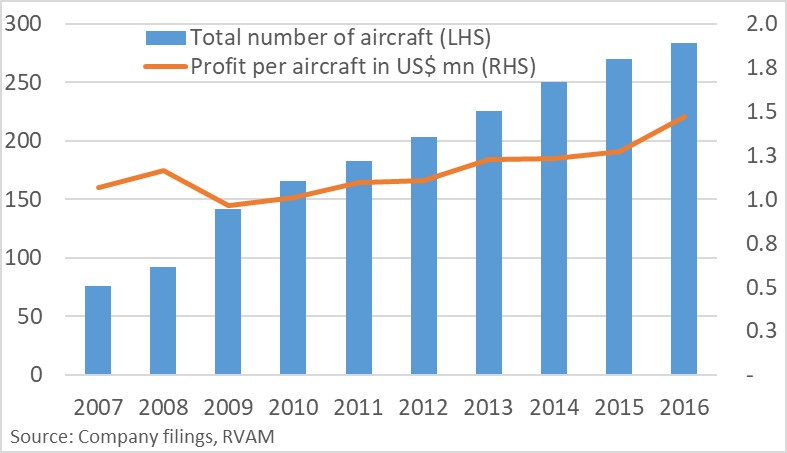

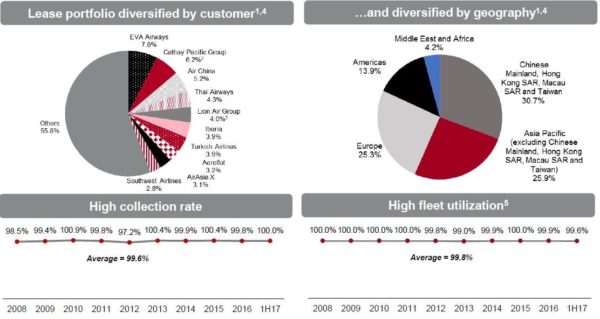

BOCA’s primary source of revenue is from long-term US$-denominated leases contracted with a globally-diversified customer base and financed by US$-denominated debt. The company buys aircraft directly from manufacturers in bulk and gives them out on long-term leases to a select group of higher quality customers. It currently has a fleet of 302 owned and managed aircraft, which has grown at a CAGR of 15.1% over the last decade. In addition, it has 197 aircraft on firm order with Boeing and Airbus, which are likely to be delivered over the next five years giving it a minimum 10%+ p.a. growth visibility over the next few years. More than 80% of the fleet is made up of single aisle A320 or B737 workhorses which are both preferred by LCCs as well as easy to resell in the secondary market. Among the leasing companies it has one of the youngest fleets with an average age of 3.2 years, and with one of the longest weighted average remaining lease lives of 7.8 years.

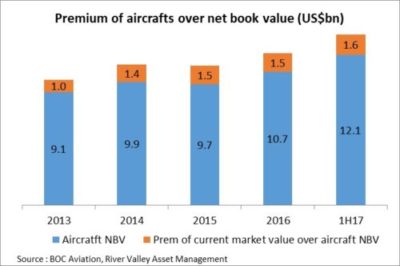

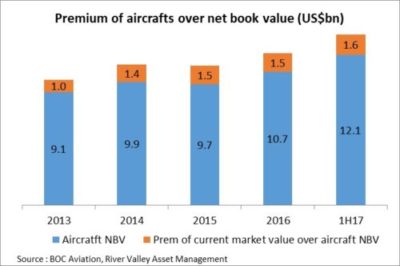

The company negotiates aircraft purchases directly with Boeing and Airbus, giving them bulk orders deliverable over a multi-year horizon, thereby getting attractive bulk discounts (estimated at 18-20% of market price) as well as locking in delivery schedules in advance. The company’s historic track record of fleet utilization – close to 100% – is impeccable (a function of its diversified and higher-than-average-quality customer mix). The chart on the right shows the current market value premium of aircraft over the book value of acquisition, thus highlighting the attractive price at which BOCA is able to purchase aircraft and thereby lock in a rate of return higher than what is available on the market.

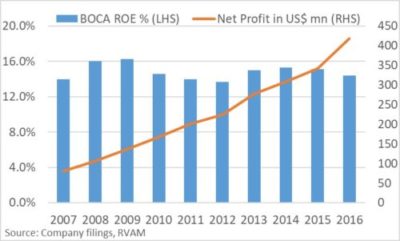

While the global airline industry has gone through multiple boom-bust cycles over the last two decades, BOCA has an enviable track record of consistently growing profits right through this period as shown in the chart on the left. Net profit in US$ terms has grown at a CAGR of 20% over the last decade driven by a consistent growth in fleet with steady ROE of 14-16% over the period.

Funding and Balance Sheet

The company has an under-levered balance sheet with leverage of 2.7x (against management comfort range of 3.5-4x) and it is the only leasing company with a credit rating of A- from both S&P Global Ratings as well as Fitch, thereby providing it with a significant funding cost advantage in the market place. Its primary source of debt funding is from unsecured bonds and unsecured and secured third-party commercial bank debt. In addition to its rating, the implicit backing provided by parent, Bank of China (70% shareholder), ensures that BOCA has one of the cheapest funding costs in the industry. The liquid balance sheet and ample lines of credit provide the management with an ability to accelerate growth faster than current order book (implied 10%), if inorganic opportunities arise.

Ability to Crystallize Value

BOCA typically enters into 10-12 year leases with its airline customers before deploying the planes. But many times, 5-6 years into the lease term, when the aircraft has sufficient operating and maintenance history, the company looks to sell the asset in the market at full market value with the balance of lease intact. It allows the company to crystallize the gain in value between a discounted purchase price and current market price of a mature operating asset. The typical customers for these transactions are Asian banks looking for avenues to deploy their capital into de-risked assets. The transaction allows BOCA to crystallize the value of risk for shareholders and at the same time keeps the fleet young, current and relevant to the market place.

Valuation and Risk

BOCA is currently trading at a 30% discount to its peers listed in the US, despite generating higher margins and returns. With close to 5% future dividend yield, we think the stock is waiting to be discovered by the market. The key risk the business model faces is from an industry downturn, a change in the interest rate environment or emerging competition. The company has weathered all these challenges over the last twenty years and has delivered consistent returns through the period, giving us confidence on the robustness of the business model.

BOCA is a great way to play the aviation-growth story with far fewer and more manageable risks than an airline investment. The stock is a consistent compounder with a visible growth pipeline of aircraft deliveries, generates good ROE, has a well-respected team of conservative managers, trades at attractive valuations, pays out a good dividend and has a well-funded balance sheet with liquidity which provides it an option to accelerate growth inorganically if opportunities arise.

RVAM’s BOCA write up has been featured by SumZero as one of the Top 15 stock ideas for 2018.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.