A year ago, if someone had made a prognosis that a majority of humankind would still be under some form of lockdown today, it would have been difficult to imagine markets trading at current levels. But then we have gone through many unusual times over the recent past. Our lives continue to be turned upside down while markets continue to be on steroids, defying bulls and bears in equal measure. Lockdown beneficiaries continue to do well, as do reopening trades. Something has to give but nobody wants to take the punch bowl away, least of all the central banks who continue to believe in their role of the ultimate grandmaster who has to deliver certainty in an uncertain world.

Six months ago, with vaccine approvals on the horizon, many of us especially in Asia were breathing a sigh of relief. We were expecting travel to open up in the near future, liberating us from the cloistered life many of us have been forced to lead, sitting in front of screens with endless video calls, switching between work to personal to social all within the settings of the same four walls. With Asia having handled the pandemic better than many developed countries of the West, the expectation of a quicker road back to normal was not just a genuine desire for many but also supported by facts on the ground. Perhaps that was hubris or complacency, but with fresh COVID-19 outbreaks driving lockdowns across Asia, international travel increasingly seems like that fleeting hope which is so near yet so far away. Strict quarantine measures with impossible expectations of near-zero COVID-19 cases increasingly present a Hobson’s choice of pandemic control. This virus seems like it will be endemic and the key question now is when Asian societies and governments will accept this paradigm and learn to live with the virus with immunity slowly building up with vaccinations.

The Rising Graphs Of Asia

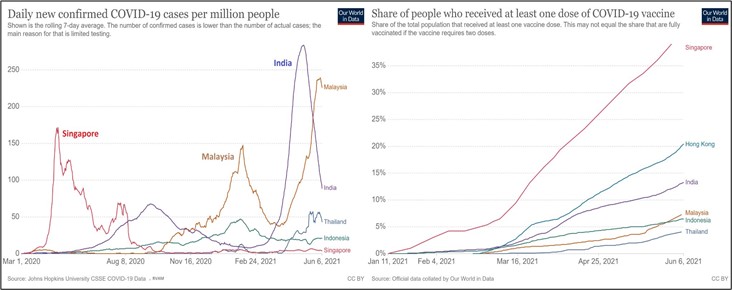

April broke the hubris in Asia with a stratospheric rise of cases in India driven by the new Delta variant of the coronavirus, which turned out to be highly contagious and leaked to other parts of Asia, driving authorities to roll in lockdowns. What has not helped Asia is the slow pace of vaccinations which leave most countries in the region vulnerable to spikes from emergence of further new variants. Going into the second half of the year, the developed countries of the West which have shown tremendous vaccination progress are likely to open up their economies, which is likely to further widen the global divide between rich and poor as the developing world lags in vaccinations.

Unfortunately, past success in containing the virus and a lack of urgency in ordering “untested” vaccines has resulted in Asia falling behind in the vaccination race. Lockdowns forced by spikes from new variants are finally driving Asia to show a sense of urgency, though only Singapore seems ready for relaxation by the end of the year, based on its rates of vaccination (as seen in graph above). While most of Europe and the U.S. are seeing current vaccination rates running at 40-60% of the population, the majority of Asia is languishing in the 5-20% range. The economic costs of prolonged lockdowns could be something that markets may finally start worrying about as Asia goes about its slow grind up the vaccination curve.

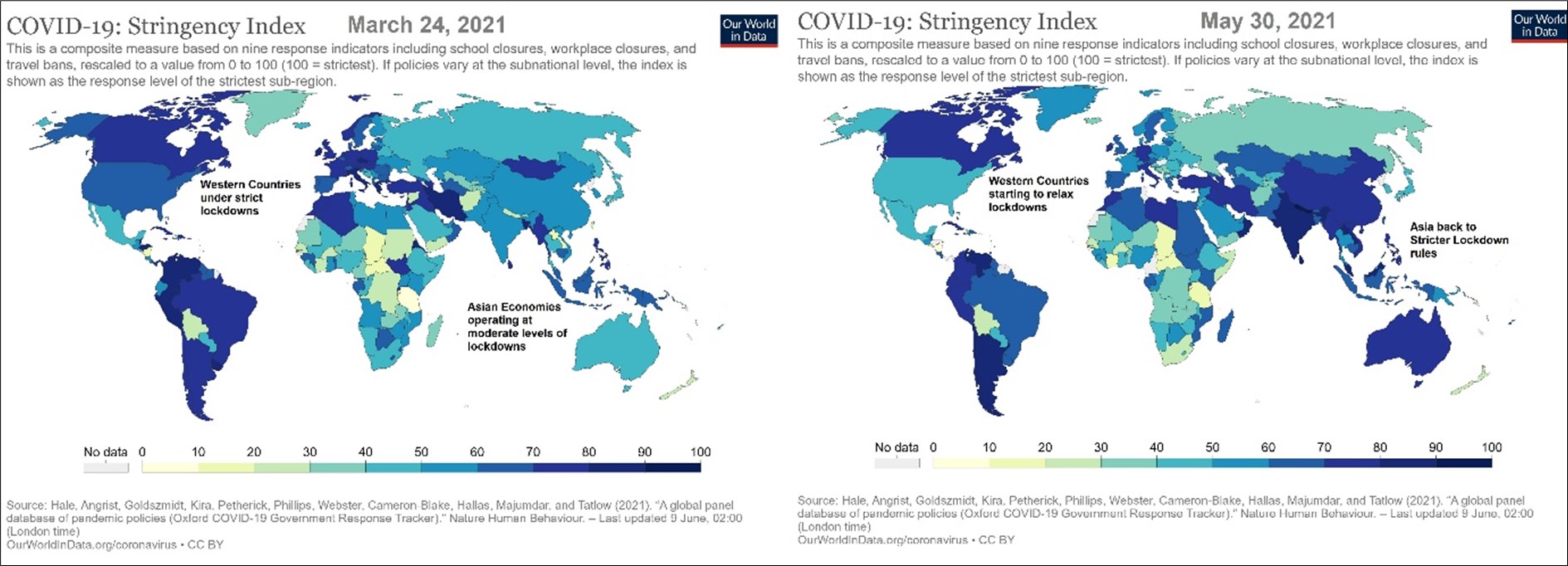

The chart below depicts lockdown intensity across two time frames. While the West, which was operating under strict restrictions in March 2021, is slowly relaxing going into June, Asia has moved the other way, from moderate levels of lockdown to stricter regimes now.

Unintended Side-Effects

The mutations of the virus are not only escaping established control protocols but creating new challenges as human beings try to battle their effects. In India, an extremely rare fungal infection called mucormycosis is on the rise among recovering and recovered-but-vulnerable COVID-19 patients. Colloquially referred to as “black fungus” due to its dark pigmentation, this potentially fatal infection starts in the nose and spreads to the eyes and then the brain. Public health experts are blaming the indiscriminate use of steroids to treat COVID-19 as the likely cause. Steroids are used to reduce inflammation in COVID-19 patients, but due to pre-existing medical conditions it is resulting in side-effects which are causing harm that outweighs the benefits.

Steroids, in common parlance, are man-made versions of hormones that are found naturally in the human body and help reduce inflammation or provide a boost to growth. Steroids do not cure, but they are good at helping to ease symptoms. Unfortunately, they have side effects and prolonged usage can increase the risk of exacerbating pre-existing conditions or present new complications. It is not just the medical fraternity which is dealing with this “Jekyll and Hyde” problem of steroids. Increasingly, the S word is frequently popping up in the financial lexicon, a reflection of the unintended effects of policy maker actions as they try to control the economic impact of coronavirus lockdowns, creating newer challenges for the world.

Markets Battling Steroids

In our monthly write-ups over the last year, we have been documenting unintended consequences of policy actions. In February 2021, we wrote about the risk of inflation from loose monetary policies, while in May 2021 we highlighted the rising trend of retail participation in equity markets around the world. What is increasingly becoming the norm in markets are exponential price curves as COVID-19 policies are boosting anything and everything up.

The chart above shows a collection of graphs from various segments of the market: old economy commodity price (steel); share price of market darling Tesla; Bitcoin, a revolutionary concept which is still trying to find a role in real life; and the share price of AMC Entertainment, a nearly bankrupt theatre chain whose business disappeared due to COVID-19, but which became a meme stock discovered by retail investors. What is common among all these price graphs is the indirect impact of policy boost in helping them reach their present levels. But that could potentially change in the near future.

The demand for commodities is being boosted by policy support, while supply is suffering due to coronavirus disruptions, amplifying prices. Asset markets continue to be supported by liquidity measures which are unable to flow into the real economy as continuing lockdown measures crimp demand for capital. Job support via income measures is boosting savings at the same moment as restrictions are curtailing discretionary spending, giving retail investors the excess capital to speculate in financial markets. The unintended boost from ‘policy steroids’ is distorting variables across the spectrum of economic activity in most markets.

The Way Forward

Economies of Europe and the U.S. are likely to look towards relaxation of lockdowns and normalizing activity levels as vaccination rates hit 60-70%, a number which gives epidemiologists comfort about potential herd immunity. We are likely to see that in the latter part of the northern hemisphere summer and it is reasonable to expect a roll back of some of the stimulus measures, income support policies and loose monetary stance of central banks. Clearly, the need to manage the future fallout of exceptional COVID-19 measures is now occupying policy makers’ minds. The recent agreement by G7 on a minimum global corporate tax rate of 15% telegraphs the fact that payback time is coming soon. Leverage taken on to provide steroids to the economy during the pandemic needs to be paid back from future activity levels.

Markets are increasingly fixated on the risk of a repeat of 2013’s taper tantrum when the U.S. Fed reversed accommodative policies the last time around. The good news for Asia is that unlike the past, countries in the region are in a better fiscal shape this time around, something which we wrote about in our November 2020 monthly piece, the Resurgence of Asia. Unfortunately, due to lagging vaccination programs we are likely to see a growth differential emerge between the developed and emerging economies and it is unlikely to close before 2022, unless the coronavirus miraculously disappears.

It is a matter of time before the liquidity punch bowl is taken away from markets. These are times when investors need to exercise caution and give as much importance to capital preservation as they give to the expectation of capital appreciation. Steroids always have side effects and that is why doctors advise use in moderation. Market participants mesmerized by the upward sloping boost from liquidity need to realize that payback time could be approaching and moderating enthusiasm could help long term wealth accumulation.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.