The Crisis So Far: A Bad 15 Months, But Human Ingenuity Continues To Positively Surprise

As the coronavirus crisis goes into its sixth quarter, much has changed from the early panic the world went through in the first quarter of 2020. While the world has lost a lot in terms of life, livelihood and its innocence vis-à-vis the dangers posed by such organisms, it has learned a lot too. It has learned that the real monsters in our world are not the Godzillas, the aliens or even war and weapons of mass destruction as portrayed by Hollywood movies. The most potent monsters are the ones we cannot see – the small microbes, the viruses, the germs. We have officially seen nearly three million (and counting) of our fellow humans die of this disease since the beginning of last year.

We have also tested our scientific prowess to the fullest and come out looking quite strong. When it involves enabling millions to use technology to work remotely, to shop and entertain remotely, to get medicated remotely, and so on, we have discovered how far we have improved these capabilities. Most importantly, we have discovered how fast we could use our technological capabilities to create test equipment, treatments and, above all, vaccines. Remember those early days when the experts would remind us that no reliable vaccine has been created in the past in less than 4-5 years? Well, here we are 15 months into the pandemic, and we have already vaccinated nearly 6% of humanity and are building up pace to vaccinate nearly 4% of humanity a month and accelerating. Which means that over 40% of humanity could be vaccinated by the year end, in an amazingly short period of only 12 months since the vaccines came out. This is an achievement that would have been unbelievable even two years ago.

Re-infection And Vaccination: Stronger Governance Structures And Deeper Purses Win The Race

Now the race is on between the rate of spread of infection and the pace of vaccination. While shutdowns and social isolation have helped in slowing the pace of infection, they have taken a large economic and emotional toll. Hence the eagerness to re-open. This has often led to re-openings in many countries happening earlier than epidemiologists would advise. This explains the large recent resurgence in infection rates in some countries. This is especially true in countries which do not have either the economic muscle or the governance structure to maintain the shutdowns. Here, the developing economies (especially the democracies amongst them, which tend to have slower-moving governance structures) look the most vulnerable.

Infections: The Next Wave Is Happening Stronger And Faster Than The Earlier Ones

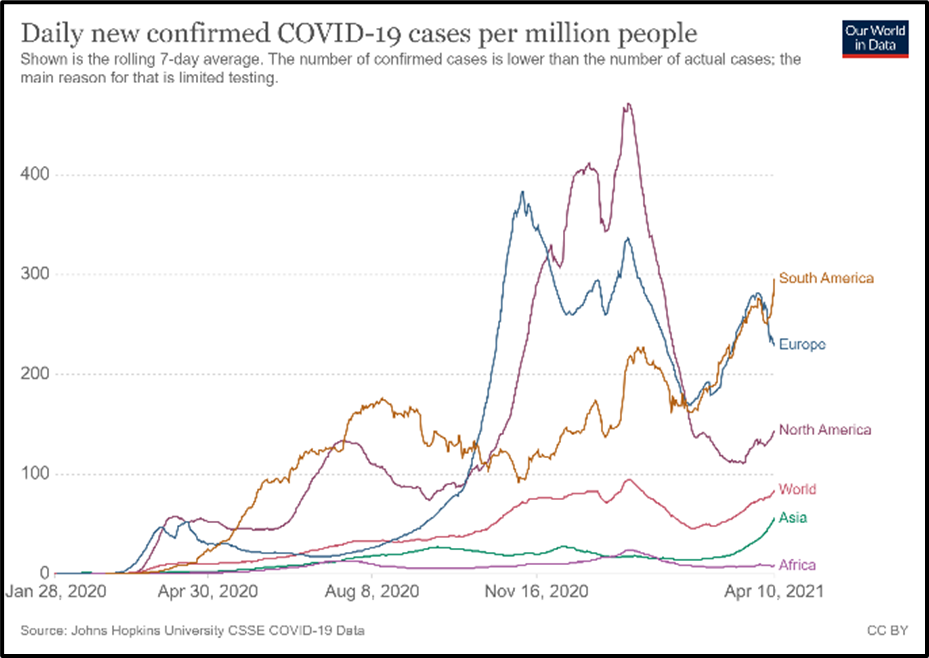

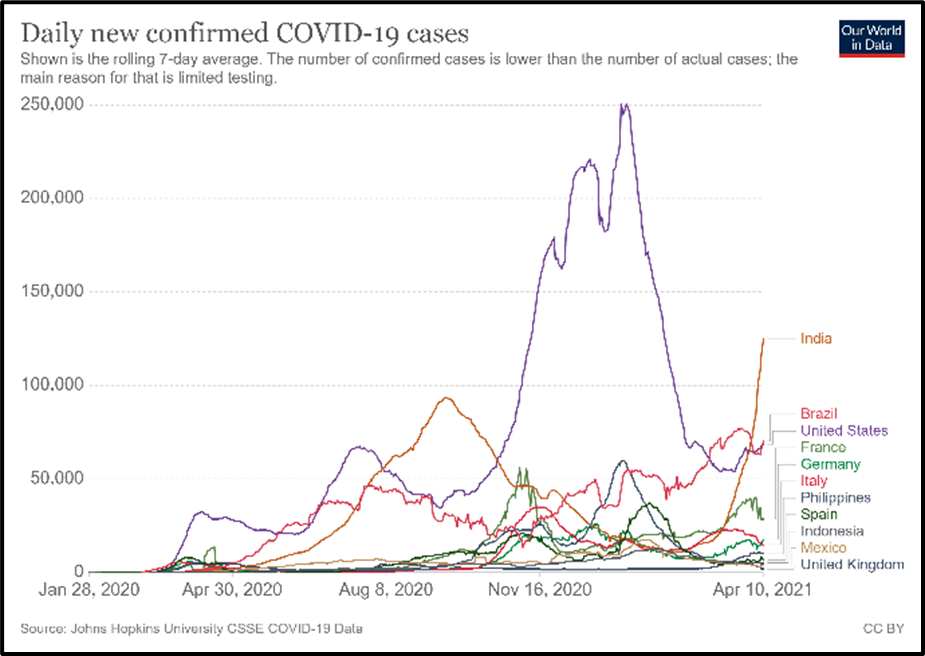

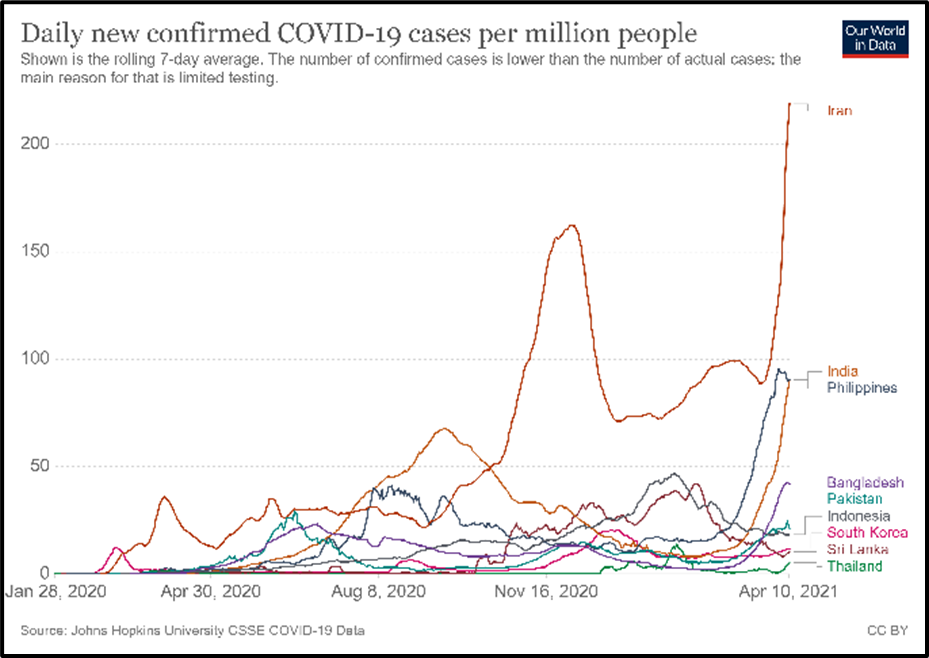

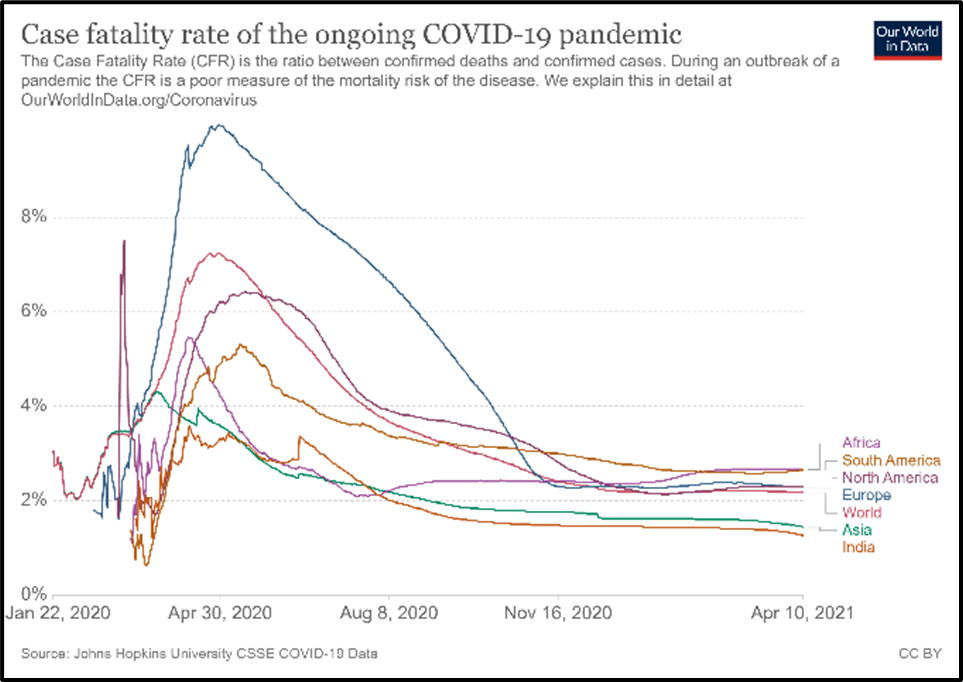

COVID-19 cases across the world are having strong second waves. Though these waves have not exactly coincided across geographies, they have been comparable to if not stronger than the first wave which peaked in the middle of last year. The current global daily tally of new cases is only 10% below the peak of early January this year and will potentially reach there soon. The big difference this time is that the numbers are being pushed up now by Asia (primarily South Asia and some countries in South East Asia) and South America. The previous peak was primarily created by spikes in North America and Europe. This has an important implication: the earlier peaks were created by cases in parts of the world which now have a much stronger access to vaccines and are generally the wealthier parts of the world and hence better able to create economic safety nets in case of temporary economic shutdowns. The current peaks are being created by cases in developing countries and hence the impact might be more difficult to deal with.

But, as always, there is a silver lining: the mortality rates are much lower. The cases are being discovered much earlier in the disease lifecycle, the medical fraternity is a lot more prepared in terms of how to treat patients and the population of these countries is much younger. Hence, the impact should not be anywhere near as bad as it was in the early phases. Despite this, the pressure to re-shut some of these economies is rising rapidly and some of the governments do not have the financial or the political capital to push as hard as they did during the first shutdowns. Hence the human toll could again be bad.

Vaccination: The Pace Is Picking Up Rapidly, But It Is Very Unevenly Spread

The Developed Countries Are Racing Ahead

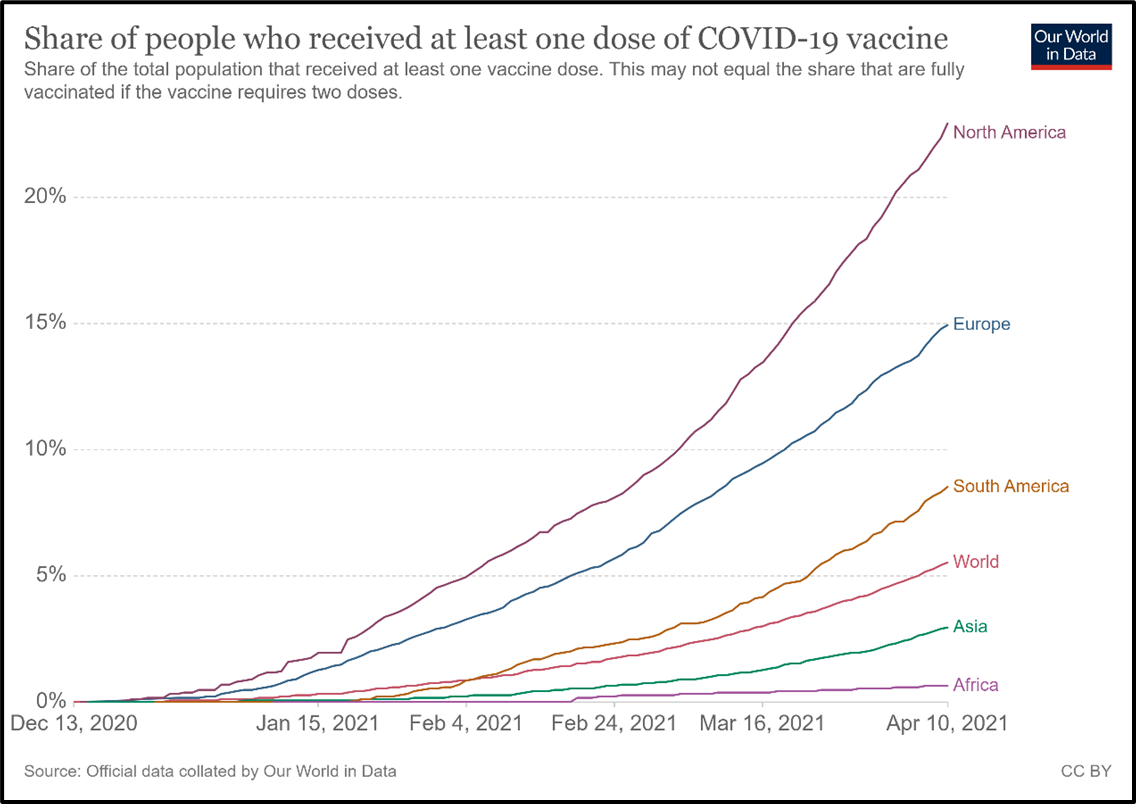

This is the second race, and it is accelerating. About 6% of the world has got at least one vaccine shot so far and this is growing at about 0.9% per week. But the pace and level of vaccination has been varying quite a lot across countries and continents. Nearly 25% of North America is already vaccinated and over 16% of Europe. On the other hand, less than 1% of Africa has got at least one dose of the vaccine and Asia is at about 5%. There is a clear difference here between the haves and the have-nots.

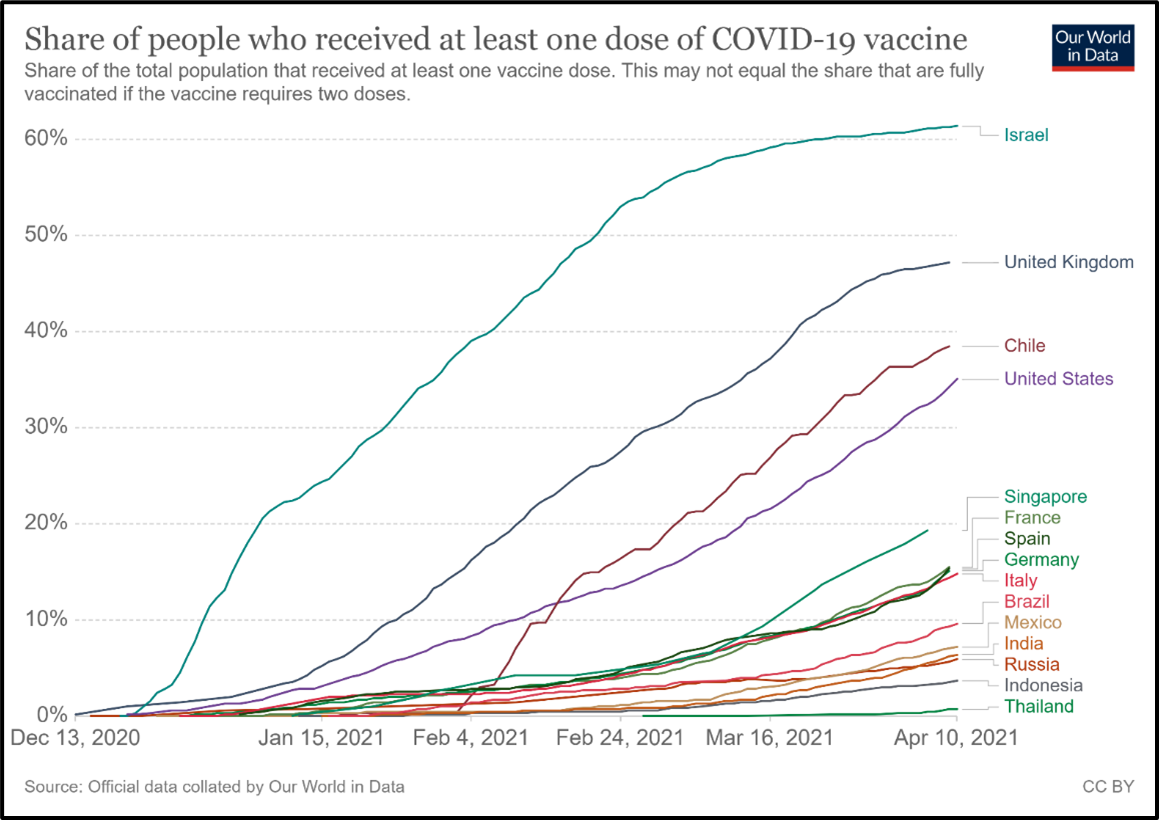

Not only have the richer parts of the world vaccinated more of their populations so far, but their vaccinations are also progressing at a faster pace. For example, already about a third of all Americans have got at least one dose and this number is growing at about 4% a week. This means that in about ten weeks, nearly 75% of Americans would have got at least one dose of the vaccine; this is broadly the threshold for herd immunity. The U.K. is even further ahead with nearly 50% of the population having received at least one vaccine shot, though the pace of vaccination there is slowing down. Even countries in continental Europe are now slowly getting their act together after faltering in their vaccine roll out in the first few months. Germany has already got 15% of its population vaccinated and is vaccinating at about 3% per week. Hence for Germany, herd immunity will happen in about twenty weeks’ time.

The Emerging Markets Are A Mixed Bag At Best

Within the emerging markets, a few countries seem to be slightly ahead of the pack. Brazil is reaching vaccination levels of 10% and growing at about 2% a week. India, the current epicentre of the spike in new cases, is at about 7% and also growing at about 2% a week. These markets might also head towards the herd immunity percentage by the end of the year. This would be through a combination of vaccinations and an increased number of recovered patients. Though these numbers give some hope for even these developing markets, the strain on their healthcare facilities and the consequent economic impact might be much higher than in the developed markets.

The group left furthest behind are the ones with low and slow vaccination rates. The worst amongst these is Africa which unfortunately is last in queue on this front. Only about 0.7% of Africans have got vaccinated and this is growing at only about 0.1% a week. Here, the disparity vis-à-vis the developed world is stark and heart breaking.

The next amongst these with low and slow rates of vaccinations are some of the richer Asian economies with low infection rates like Australia, Japan, Korea and Taiwan (potentially also China, but here the data is erratic). For example, only about 0.9% of the Japanese have been vaccinated and this is growing at less than 0.2% a week; similarly, the Korean numbers are 2.26% and growing at only 0.4% per week. Even though some of these countries are currently seeing a spike in numbers off a very low base, they seem to be content to lag behind in the vaccine queue. Their current human toll is not that high and they have enough economic might to remain quasi closed for longer. Most importantly these could see rapid growth in vaccination in the coming months.

The third in the group of those with low and slow rates of vaccinations are primarily the Asean countries ex-Singapore. Singapore is doing a good job with nearly 20% vaccinated and growing at about 3.5% a week. But the rest of the countries are lagging a lot. Indonesia is at only 3.7% vaccinated and increasing at only 0.6% a week. Thailand and Philippines are less than 1% vaccinated and growing at less than 0.2% a week. These are the worrying economies as some of them, like the Philippines, are currently seeing genuine second spikes in infections. The vaccination numbers here could improve quickly, but if they do not, their opening up would really take off only in 2022.

The Impact On Economies And Markets

The outcome of these two races – the pace of infection and the pace of vaccination – will finally impact the race that really matters: the pace of economic normalisation. Here, there is a clear hierarchy. The U.S. (also, potentially, the U.K.) is clearly ahead. Europe, which has been needlessly maligned for its vaccine strategy, is only behind by a month or two. But the impact on markets (especially in the U.S.) might be more muted as a lot of this opening up is already getting priced in. In fact, the more useful take away from this could be the fact that the Fed normalisation (tightening) cycle might start earlier than expected.

China has already opened up, not because of a high level of vaccination but due to better control of the virus by track and trace methods. Emerging markets is where the outcome is mixed. Markets like India, which have run up a lot on the opening up trade, could face head winds as the resurgence meets vaccination rates which are good but not good enough. Even though India might come out of this faster than other similar economies, the impact on markets might be equally negative given the current optimism.

The interesting markets are the Asean group, which are lagging in vaccination rates but have kept infections in check (except the Philippines where there is a resurgence). Here, the base case has to be that the vaccination rates will pick up but with a lag and hence true opening up could lag countries like India by about 3-6 months. Here, markets have not run up as much and hence there might be more opportunities.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.