2020 is turning out to be unusual in many ways, maybe a bit of an understatement with the coronavirus continuing its rampage while stock markets on the other hand keep grinding higher. The virus keeps popping up in unexpected places, driving case counts exponentially, keeping people closeted at home and impacting economic activity, while anybody looking at markets could be pardoned for wondering “where is the crisis?” It does not take a lot of effort to look around and be convinced that we do have an economic challenge, but then with “QE infinity” creating overnight riches and stock markets being talked about in the same breath as online casinos, favoured by small investors, the last few months have been anything but uninteresting. What is becoming apparent is that recovery from the bottom is not going to be uniform and that various countries and sectors would follow many different paths; to deal with the range of issues this throws up, investors need to be ready to adjust to a changing normal, the outcomes of which are hard to anticipate.

The Rampaging Coronavirus

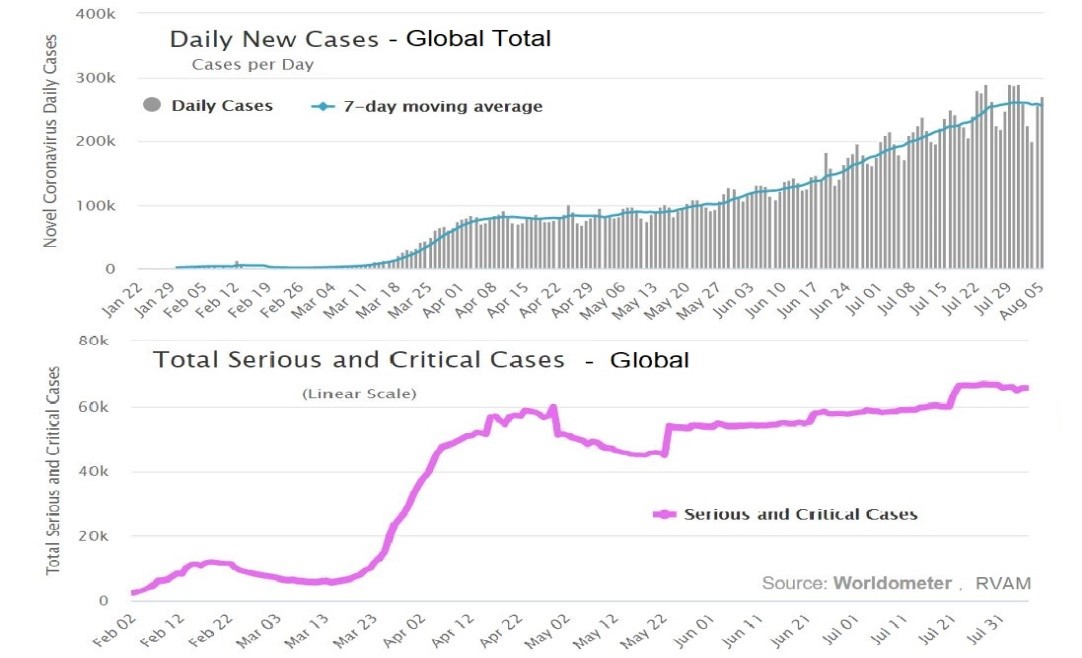

The precursor to understanding economies and investment opportunities in the current environment is to take stock of where we are on the pandemic that continues to bedevil experts, leaving its imprint strongly on human behaviour, driving actions both of commission and omission. Writing in our April monthly “Life After Armageddon”, our base case expectation was for life to slowly limp back to normal as authorities get better control over testing and as the nature of the virus was understood better. In that we had an early template – China. The global impact of the virus was expected to peak out in the second quarter, with potential risk from a second wave resurgence as the weather turned cold later in the year. The roadmap has played out to expectation in China, but the rest of the world is limping about in a directionless fashion. The virus continues to make new highs (chart alongside), crossing 20mn cumulative cases – more than 10x the number of cases observed till Easter – appearing in unexpected places, keeping human beings socially apart and increasingly taking its toll on economic activity.

The medical profession now has a better understanding of the virus and is able to manage the epidemic better, though society at large has been unable to use time-tested solutions like social distancing to impede the spread and ring-fence the vulnerable segments of the population. The worrying aspect is the stubbornness of the number of serious and critical cases globally. Till we reach a point where fatalities start trending down, the confidence to go about life in a normal manner will be the casualty and economic activity will be hobbled by human constraints.

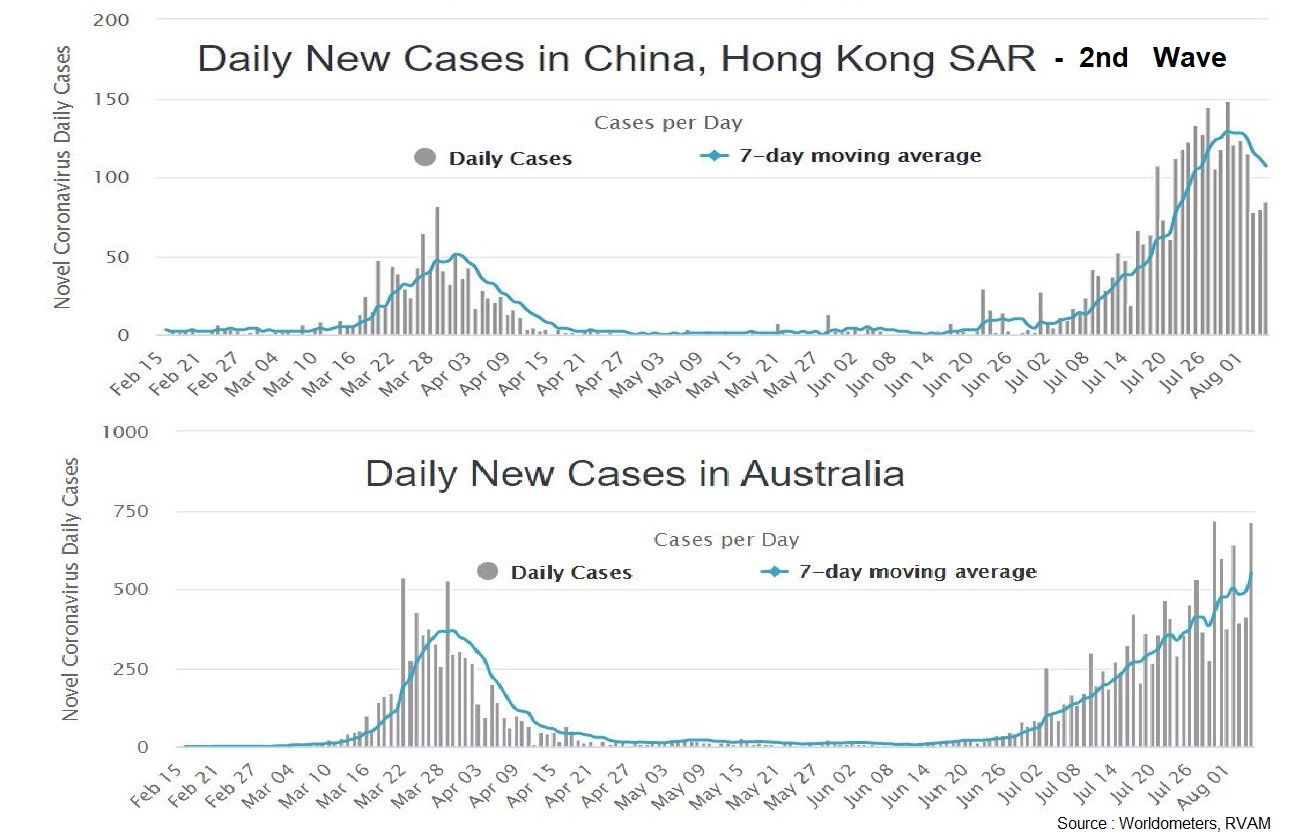

The issue is not just about flare ups in difficult-to-control segments of the global population, whether it be the ideologically misinformed parts of the U.S. or resource-poor emerging markets like India or Brazil, but also in countries which were lauded as having done a great job of managing the initial days of the pandemic, like Hong Kong and Australia. All of these have seen a second surge the moment they started opening up their economies over recent months (chart alongside). Similar reports are coming from parts of Europe which started opening cautiously, like Spain.

The likelihood that the coronavirus is here to stay looms large; it may become endemic. That it can spread easily seems its nature, but to slow it down is within human capability, if we heed common sense and apply the lessons of science. Hope now rests on vaccines where researchers have made rapid progress, with resources being committed by the public as well as the private sector, helped along by regulatory agencies accelerating the timelines. However, even with a vaccine which is expected by early 2021, nobody knows what the other side of COVID-19 would look like. What we know is that the longer it takes for most of the global population to get confidence, the larger would be the economic costs.

Rising Economic Costs

Economists and market watchers have been running their models, brushing up lessons from the past, playing a crystal ball gazing game of who can predict the right recovery alphabet – U, V, W, Swoosh, L, etc. But with time what is becoming apparent is that some parts of the economy are going to fundamentally change forever. The trends observed over the last few months – of furloughs and work from home – may not last to the end of the year as the enabling current environment (of generous fiscal support and forbearance) gives way to hard choices for businesses as demand recovery is pushed out and investments are postponed in a world awash with a rising debt load, though floating in oceans of liquidity.

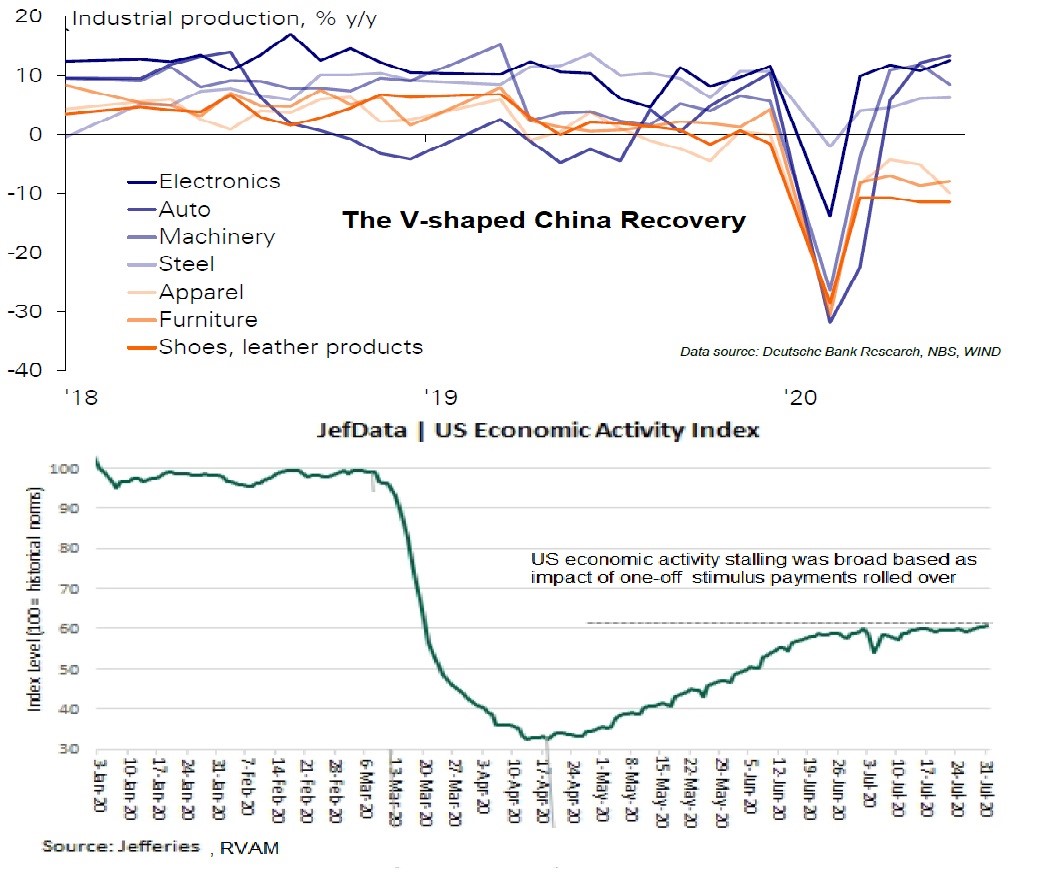

It is useful to look at China which has seen rapid economic recovery (with abatement of the virus cases), partly helped by policy relaxation accompanied by an investment stimulus. While GDP in the 2Q jumped back up to growth territory (3.2% yoy), underneath are signs that consumer confidence is still bearing coronavirus scars. Despite hardly any new cases, people are reluctant to socialise, and consumption recovery is taking longer than expected. Restaurants in the last week of July were still reporting revenues of -30% yoy, while railway passenger traffic is running 42% below last year’s level. Metro lines in the large cities in China are seeing footfalls in the range of -15% to -40% as people avoid crowds and instead look to use their vehicles, driving a demand spurt in automobile sales. If this is what the new normal looks like, western societies, which are more consumption driven, are going to take a long time to recover from this shock; this is particularly true of the U.S. where air passenger traffic is currently running at -77% yoy.

Given the global unease with travel, it is easy to dismiss the aviation industry, but the fallout is something that cannot be ignored as this industry contributes 3.6% of global GDP (5% in the case of the U.S.) – far greater than the contribution of the automobile manufacturing sector or the pharmaceutical industry – and supporting about 65.5mn jobs. Hopes of a V-shaped recovery have kept the industry in suspended animation, but the longer the delay, the more painful would be the restructuring impact and the collateral damage.

Despite strong policy support provided over the last few months, as it becomes apparent that the majority of the world (ex-China) is unlikely to see a V-shaped recovery, it is worth trying to understand the ramifications. Most governments around the world followed similar policies in the first half of the year to tackle the pandemic – implementing widespread lockdowns with hopes of flattening the curve and offsetting the immediate economic impact with significant one-off fiscal transfers and a massively accommodating monetary stance. With rising debt and falling revenues (due to contracting economies), the fiscal space to continue providing support measures is diminishing for most countries. If the virus continues to float around in the populations i.e. becoming endemic, many sectors of the economy would face permanent damage. This conundrum is apparent in the largest economy in the world, the U.S., where a stalling of activity levels became visible as soon as the initial fiscal support measures ran through their course in June 2020.

The chart alongside shows the stark divergence in the shapes of the recovery in the two largest economies in the world – China and the U.S. While the former has seen growth jump back up to positive territory, activity indicators in the latter indicate a July GDP run rate of -6% to -7% yoy, slightly better than the -9.5% yoy for the 2Q of 2020. The income stimulus provided by western governments at a time when output in most of their economies was below normal seems to have helped the factory of the world, China, to recover faster. A boost to export demand combined with domestic stimulus brought enough orders to ramp utilisation back up to normal. The result of this is clearly visible in China’s trade surplus numbers which are showing a strong positive month-on-month trend and are offsetting the deteriorating trade balance, especially with the U.S. This trend is not going to go unnoticed by Donald Trump who, after spending the best part of his four-year term trying to bring the trade deficit down, is unlikely to be thrilled to see it rise going into the home stretch of his re-election campaign. Unfortunately, service payments (including tourist spending) which were a big component of Chinese efforts to re-balance deficits have been the biggest casualty of the coronavirus pandemic. Markets need to be braced for more unexpected U.S.-China trade spats.

The Triple Whammy

Having front loaded many policy actions with a “whatever it takes” approach to help economies, decision makers now have to live with a diminished armoury of “whatever is left” policy tools to deal with the lingering coronavirus uncertainty. Global economies have to learn to live with the long-term impact of Debt, Deleveraging and De-globalisation. With a long road to full economic recovery, policy tools will have to remain conducive. We touched on this world of zero interest rates – of “QE Infinity” – in our write up last month “Now that we are all Japanese, what does the future hold?”.

Despite significant rebounds in major equity indices, professional investors are behaving like fully-invested bears, looking at reasons for market correction at a time when they also seem to have the confidence to own many good businesses that are still attractively valued. The puzzle is explained by the narrowness of the current market rally, causing the same set of expensive stocks to become more expensive. The quantum jump in the participation of stuck-at-home retail investors who typically chase popular trends (the Robinhood craze) has exacerbated this anomaly in most markets.

Global equity markets are grappling with a triple conundrum of issues:

- the impact of the current economic dislocation,

- continuing under-performance of the value factor, and

- ESG moving from the periphery to the mainstream.

The trinity has led to one segment of the market trading at valuations that defy conventional wisdom. The process of ignoring companies which are pariahs on one or more of the three issues has led investors to commit the proverbial act of “throwing the baby out with the bath water”, thereby providing patient participants with interesting opportunities to pick companies for the long run.

Across sectors we are finding examples of good businesses being ignored, thus offering great value. The question to ponder is whether these provide cyclical recovery opportunities or have permanently derated. COVID-19 presented the consumer staples sector a great opportunity to stand out due to demand resilience with strong cashflow. But within the sector, tobacco stocks continued their derating trend despite offering juicy dividends in an environment of low interest rates. The uncertainty brought about by the coronavirus has made investors shun certain discretionary sectors like automobiles (even as demand is recovering strongly) but favour luxury, while Tesla, the ESG darling, keeps surging, trying to outreach its founder to the sky, incidentally ignoring the fact that it also makes automobiles and can have case studies written on its patchy governance record.

Financials as a sector is uniformly unloved in every market in the world with stocks trading at the lower end of their historic valuation ranges. While uncertainty about the economic environment can explain investor caution, the relative cheapness vis-à-vis other economically sensitive sectors points towards continuation of a trend observed over the last decade: under-performance of value investing over growth.

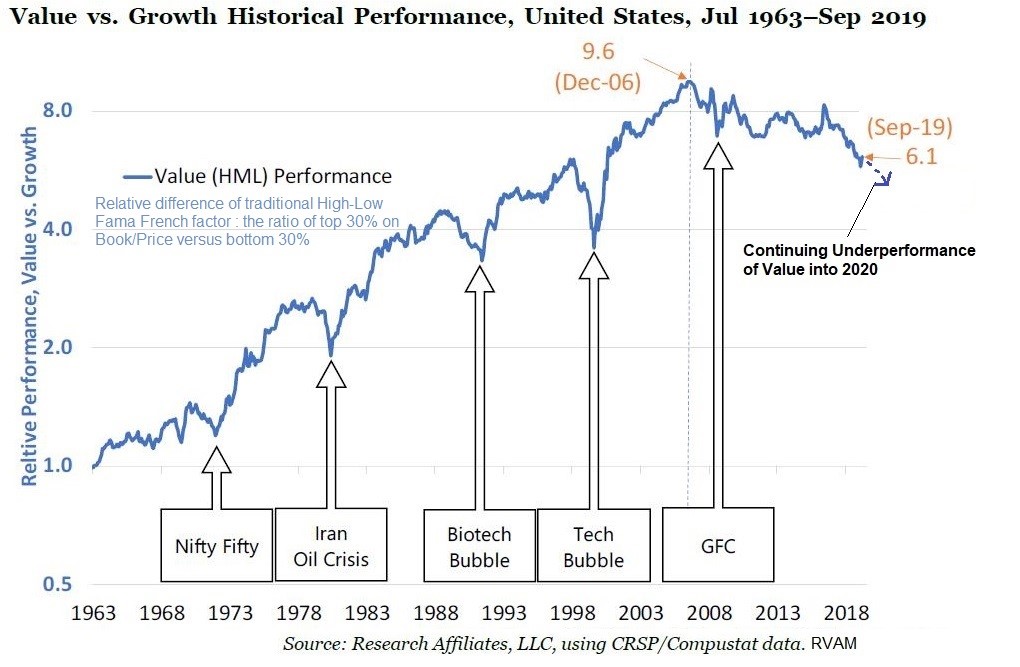

Why Is Value Out of Favour For So Long?

Given the strong historic record of value investing and its solid economic foundations, the persistence of value under-performance over the last decade has led to many detailed research papers being written on this phenomenon. Various factors have been identified and many narratives purport to explain why “this time it is different” and hypothesise why value could be structurally impaired. The chart alongside shows the trend of Value versus Growth as measured by traditional book value metrics in the U.S.

The most commonly offered narratives for Value being dead focus on a) technological change, b) low interest rates, c) rise of intangibles in book value, d) crowded trade, e) growth of private markets, and f) structural changes in profitability. Most of these factors have existed in varying forms and have come and gone in the past. What is true is the fact that we have been living in an extraordinary period of monetary easing with lower than normal rates for the last decade, a period where profit growth has been skewed towards a narrow winner-takes-all sector: technology. This has driven the valuation differential for this narrow universe towards an extreme.

Historically, Value outperforms due to mean-reversion in financial markets. The combination of economic cycles and regulatory interventions have ensured that excess profitability does not sustain for prolonged periods of time but gets competed away when trends drivers of each cycle change or new competitors enter the market. The current new era paradigm of “QE Infinity”, where central banks are happy to intervene and offer a “put” on the cycle, thus trying to elongate expansions with no exit plans, is prolonging the divergence.

Valuation is a function of cashflow expectation discounted back at an appropriate current discount rate. An environment where excess profitability has persisted without regulatory intervention, combined with depressed rates, provides enough justification for continuance of a high valuation multiple for a sector like technology where cashflow pools keep growing. With interest rates likely to remain depressed for a prolonged period, what can change this narrative would be regulatory intervention. From that perspective it would be important to pay attention to the outcome of the Congressional hearing on abuse of monopoly power in the technology sector in the U.S. The four CEOs of the most profitable companies in the world – Apple, Google, Amazon and Facebook – testified jointly towards the end of last month to the House Judiciary Committee’s antitrust panel in Washington. What struck us was the identical nationalistic pitch adopted by all of them – “we are great companies because we are American” – trying to deflect the anti-competitive issues the panel was focused on.

Clearly, the risk to this narrow market rally driven by the technology sector is regulatory intervention or escalation of the U.S.-China rhetoric which would unravel the deep trans-pacific linkages built over decades. Technology companies whether in China or America cannot unwind their symbiotic relationships easily without causing significant damage to each other, despite what politicians in either capitals want. And therein lies the risk to the current market rally.

Coming back to value stocks, we think some of them nicely play into a global recovery theme. We already own a few of them. The coronavirus scare is not likely to last for ever. Economies will limp back to normal and markets will start pricing this in way before indicators confirm the facts. It is strange that one can be a bull and a bear at the same time. But then the world has changed due to the coronavirus. As we enter the recovery phase, it is apparent that we are not going to see a single template and that various parts of the world will zig-zag in their own way before settling into a normal phase of activity. As market participants we need to be aware of this changing normal and adapt to it.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.