Identifying the potential for change is a key driver of investment decision-making. To do that with some degree of accuracy and expertise for any trade or business, one needs to build expertise and knowledge and the best way to do that is to immerse oneself in the industry over a period of time. Trendspotting isn’t just for the fashionistas, we assure you. We do it all the time, sitting in our dull offices, rather than taking a prime seat by the catwalks or sauntering around high streets in the meccas of fashion. While the latter may sound like a lot of fun, our kind of trendspotting comes with its own thrills (and spills too if we get it wrong!)

There is a big difference though. The trends we are talking about tend to be structural shifts that are longer term in nature and have irreversible consequences where they develop. These could be regional or global or even specific to a country. However, the magnitude of change they produce over a long period of time can be life-defining and, when measured in economic terms, very significant indeed. Most gurus term them as megatrends. The awareness of such megatrends provides us real and valuable insights about industries and companies and, more importantly, the investment edge one needs to deliver long term alpha.

Past experience shows that investors can get aboard a megatrend anywhere and ride it for a long time. People associate megatrends with life-changing occurrences such as climate change, urbanisation, the Internet, e-commerce and so on. However, we at RVAM endeavour to identify trends or themes that could be called megatrends but which may be a consequence of one or more of these over-arching ones. Additionally, they could be germane to a country or region or perhaps even the whole world.

In our opinion, many of the trends at play today had their genesis perhaps a decade ago or even longer back and our analyses suggest they would remain relevant for many more years. Each trend may be at a different stage of its maturity and hence it makes immense sense to find the right moment to participate in it, through the right company and at a price we deem reasonable to pay. In this piece, we share a few trends that we find hugely attractive, some at work in Asia and some in the world at large.

Premiumisation of Consumer Goods

Growth in consumer spending, staples and discretionary across Asia ex-Japan has been a consequence of urbanisation and uplifting of standards of living all over the world. Those who have become economically well-off and have gained from the fruits of liberalisation and globalisation in these economies, are migrating their consumption of goods and services upwards and are keen to partake of premium products and services. They are, in fact, demanding this. This mass of people is growing everywhere, every year and with it grows their demand. It is now no longer good enough for companies to cater to the ‘mass-market’ category which, more often than not, has become over-crowded with players and has seen slowing demand. We had explored this in detail in our September 2016 newsletter on the China Consumer.

We illustrate this through a nuanced look at a segment of the broader consumer products category in China that we have invested in. This is the hand and face tissue category in China through a company called Vinda International. Vinda is a mid-sized subsidiary of Essity Aktiebolag, Sweden, and has been operating in China for several years and listed in Hong Kong.

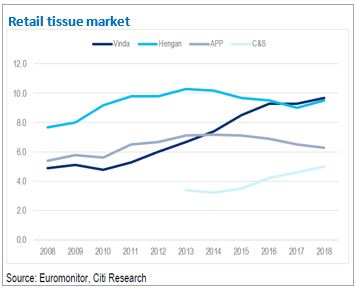

While the Chinese tissue market is still dominated by commoditized products, we see early signs of premiumisation at work already. These include diversified usage, differentiated products and high-end products/ brands gaining consumer mind share. We expect the industry overcapacity to linger for a few years. The market shares of the top four national players have changed rapidly. This is due to their different strategies amid demand premiumization and changing consumer behaviour.

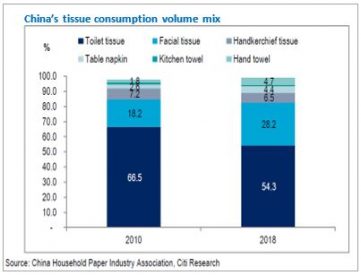

During 2010-2018, non-toilet tissue consumption volume grew at a CAGR of 13%, faster than the 6% CAGR of toilet tissue. Facial tissues, table napkins and hand towels are the major drivers among non-toilet tissues. As a result, non-toilet tissues accounted for 46% of total tissues consumption volume in 2018 – up from 33% in 2010 – and the contribution of toilet tissues decreased from 67% to 54% (see chart on the left).

Since 2015, China’s tissue consumption volume mix has been ~55%, in line with that of developed markets such as Western Europe, North America and Japan. Vinda has seized this opportunity well and has been a key beneficiary of it so far.

The chart on the right shows that the inflection point for the previous #1 and #2 players, Hengan and APP, was possibly 2013, after which both have lost market share. For Vinda, 2012-16 was the take-off period which made it #2 post 2014 and the #1 company since 2017.

The past five years in China have seen rapid consumption upgrades. In tissue products we have witnessed a fast growth in demand for facial tissues and trade-up to higher end as well as differentiated products of better quality and more specified functions. Vinda has worked hard to develop mid-to high-end products by launching its global top brands like Tempo in China.

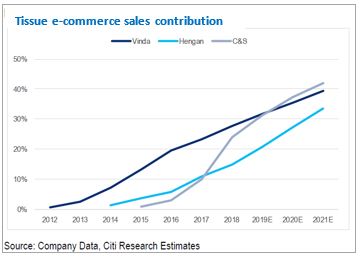

Tissue e-commerce sales have grown rapidly in the last five years. All key players have done well. During 2011-2018, the tissue industry’s growth was mainly driven by facial tissues which grew at a CAGR of 13%, much faster than toilet tissue sales CAGR of 5%. Against this background, Vinda has rapidly shifted focus from toilet rolls to facial tissues and has increased its facial tissue sales mix from 33% in 2012 to 59% in 2018. This is also the space that has embraced premiumisation most readily and the fastest.

We expect that multiple underlying trends within the tissue industry are themselves evolving, moving the industry further towards higher-priced premium products. Consumer awareness about the quality distinction and the perceived benefits of new and better products is increasing rapidly, leading to well-informed customers embracing this change rapidly. Hence, despite the fragmented nature of the industry structure, it has a long runway for growth as usage patterns develop and change in a country as vast as China. In our opinion, Vinda has been among the best positioned to play a vital role in the development of the category in China.

Insurance in Asia

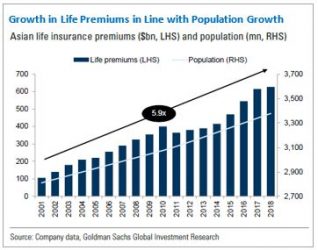

This is a well-understood story of under-penetration, population growth, favourable demographics and rising affluence, which plays well into our thesis that it is never too late to profit from a megatrend that is currently in play and will continue to be for many years to come. We couldn’t have found a better way to benefit from it than through Prudential Insurance and AIA. Both companies are structurally best positioned and could be called ‘gorillas’ within this space in Asia. They possess most attributes for success and are reaping the benefits of their individual scale, branding, geographic presence and distribution reach, a wide product slate and sufficient capital to grow in future.

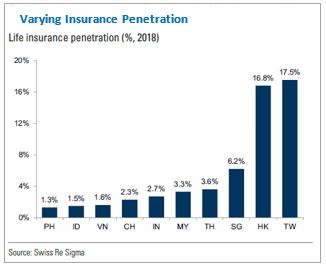

It is important to note that Prudential represents twelve markets, each with individual dynamics that have divergent levels of insurance penetration. For example, insurance penetration in the Philippines, Indonesia and Vietnam is close to 1%, while for Hong Kong and Taiwan it is over 10%.

It is well-known that insurance penetration and wealth/GDP tend to be relatively closely correlated. It isn’t surprising that those Asian countries with high insurance penetration are usually relatively affluent (e.g. Singapore, Hong Kong and Taiwan). Prudential has built strong footholds and intends to extend its leadership position.

Countries where growth could prove more transformational are those where current insurance penetration is relatively low and populations are large (e.g. China and India). These markets have the potential to offer compounding growth for many years or even decades. The Prudential group has stated a focus to grow its share and presence in these segments.

Going forward, Prudential sees structural growth drivers and government policy underpinning momentum in its six core Asian markets: the four discussed above (China, Hong Kong, Indonesia and Singapore) as well as Malaysia and India. We outline these drivers in the table alongside.

While this table projects growth till 2022, we believe that the growth horizon is actually much longer.

Sportswear and Sports Apparels

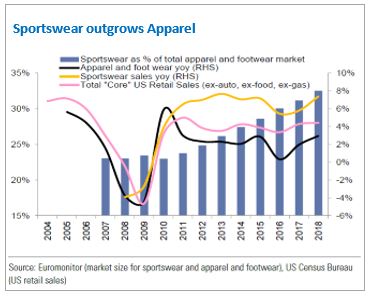

Here is another theme that has been at work for some time now, not just in Asia but all over the world. The overriding megatrend is a global move to be ‘more healthy’ in every way possible, which includes adopting a more active lifestyle, taking on new sporting activities, eating healthy foods, etc. The sportswear and sports apparels industry is one way to play this change, which we believe is not just structural now but growing in different ways unimagined previously and enabled by the use of technology and catalysed by the Internet.

There are three key components of this sector: the brands, the retailers and the manufacturers. The biggest share of the profit pool is, of course, captured by the brands – the likes of Nike, Adidas, Puma and Under Armour. But since our focus is Asia, it is the retailing part that looks most interesting to us at the valuations at present, specifically in China, the largest market for sportswear in Asia and the fastest growing big market in the world.

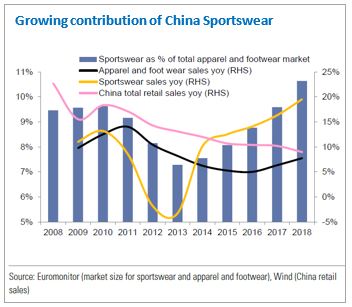

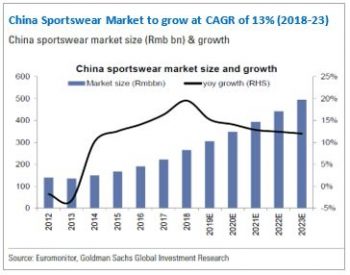

In 2018, China’s sportswear market was US$40bn in size vis-à-vis US$117bn in the U.S. However, the CAGR between 2014 and 2018 for China was 16%, compared to 6% in the U.S.

What is interesting is that in this period and beyond, it is the sportswear segment that has grown well ahead of apparel and footwear and overall retail sales in China. The same trend is visible even in the U.S.

According to Frost & Sullivan, China’s national regular sports participation rate increased from 14.7% in 2014 to 18.7% in 2018, still well behind 35.9% in the U.S. As against the U.S., the Chinese market has significant room to grow from here over time.

Overall, research by Goldman Sachs projects China’s sportswear market to grow at a CAGR of 13% between 2018 and 2023.

Help for enabling this growth comes from none other than the Chinese government’s supportive policies. In October 2016, Chinese leaders explicitly made healthy living a national political priority and the State Council introduced the “Healthy China 2030” initiative. This is one of the first initiatives with clear targets about the number of people exercising, displaying the government’s efforts to encourage people to exercise more and to be healthy.

The Chinese government estimates that 530 mn people undertake physical exercise on a regular basis – a 47% increase from the 360 mn people in 2015 – and aims to increase the percentage of residents meeting or exceeding the National Physical Evaluation Standards to 92% by 2030.

Our analysis brings us to the sportswear retailers in China specifically. Here, the offline distributors and the brands have been working together to grow the market over the last decade. As a result, these distributors are now an inextricable part of the omni-channel strategies of their principal brands, be they Nike, Adidas, Puma, Asics or any other.

There is also the well-established trend of mono-brand stores in key shopping destinations which has replaced traditional retailing. Further, the notion of comparable sales has undergone a big tweak as well. It now includes not just ASP and product. The definition is: Comp sales = transaction (traffic & conversion) x bundle rate (items sold per transaction) x ASP growth plus the size of the product bundle being sold. The obvious attempt is to push up the total customer spend at a store.

The use of technology in tracking inventory etc. is passé. To achieve the comp sales as described, retailers need to convert traffic into transactions. This is where ‘smart stores’ come in. A recent note from Jefferies research wrote thus: Converting traffic into transactions: smart stores adopt cameras and sensors to track traffic, consumers’ movement round the store and even what they look at in the store. Cloud computing tools analyse the data in real time to map “hot spots” and “cold spots” in each store. The data is fed to store managers in real time to better guide traffic. Data can also help adjust assortment (SKU and quantity) and store design. Full coverage distributors such as Topsports and Pou Sheng will, we believe, become increasingly valuable, by acting as the irreplaceable data portals to their brands.

Consolidation in the sportswear retail segment is another big sub-trend. This phenomenon has already played out in the U.S. and Europe where the top 3 or 5 retailers now account for 40-70% of the market. In China, the largest retailer Topsports has a mere 16% of the share and #2 Pou Sheng 11.6%, the rest being shared by thousands of retailers. Big brands are already consolidating this by opening more mono-brand stores through big retailers and withdrawing support to smaller multi-brand stores.

The next leg of distribution growth is happening at tier 2, 3 and 4 cities where growing affluence and development is leading to people’s aspirations rising towards big brands. This is also a part of the broader premiumisation trend playing out in China.

In a nutshell then, the growth runway for sportswear and sports apparels in China is long. Growth rates, while slowing down off a larger base, are still likely to be in the low to mid-teens over the next several years, driven by myriad factors, some of the key ones being those discussed above. We also draw attention to a sports retail business in Indonesia that we own in the portfolio which has all the underpinning of what is at play in China. Indonesia’s stage of development being weaker than China, we believe that this company’s growth prospects are truly determined by its ability to execute on its growth strategy, as the top-down thematic is well entrenched there as well.

Travel and Tourism

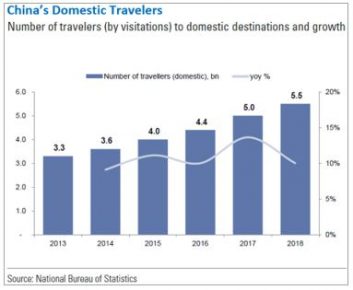

More people are flying and travelling today for business or pleasure than ever before and this megatrend is structural and isn’t likely to reverse soon. A vast majority of the people of large countries such as China and India do not own a passport yet, but that number is growing rapidly now. These vast numbers of people are travelling out of their country and experiencing foreign lands for the first time ever. With globalisation, global business travel has grown tremendously as well.

It must be noted that the recent outbreak of the novel coronavirus has disrupted global travel in and out of China and some other countries dramatically in recent weeks. This may take time to return to normalcy and will impact travel-related businesses directly and severely in this period. Yet, if one can learn from the past (as one should), such episodes of disease outbreaks have demonstrated that underlying trends reassert themselves very quickly. It has also been proven that such times have provided long term investors with the best opportunities to buy strong and durable businesses at trough valuations.

In China, which is the focus of our attention again, we believe Trip.com (erstwhile Ctrip.com) is that company which is in the left, right and centre of the travel revolution happening there.

It has built the scale, product slate, branding and technology to meet the demand and grow it. Internationally too, it has the wherewithal to match its two American competitors and has now cast its ambitions outwards beyond China.

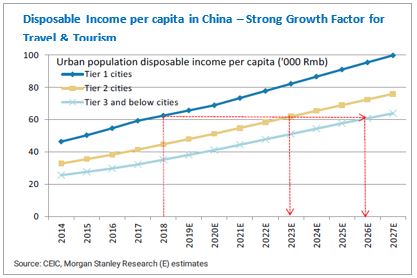

Within China itself, the room to grow its different business verticals is vast. The chart alongside shows that disposable income per capita in tier 2 and 3 cities or lower will match the 2018 level of tier 1 cities in another 5 to 8 years. This is a powerful growth factor that cannot be overlooked, especially considering the size of the population and the GDP of China today.

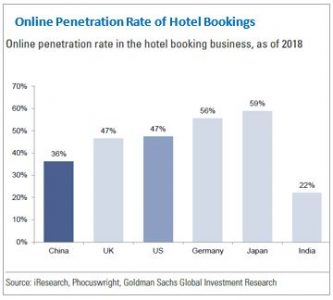

The travel market in China is more attractive than that of other markets. A few structural factors (lower online penetration rate for hotel bookings, lower chained hotel % and lower occupancy rate v/s other developed countries) all suggest larger growth opportunities in China’s online hotel booking market v/s that of mature markets. Online penetration for hotels remains low in China at >30% v/s 40-50% for the U.S. and Europe. Hotels are a much more fragmented market in China compared to the U.S. and Europe.

Consider the following growth opportunities that lie ahead for Trip.

- International business now represents 35% of group revenue (outbound + overseas). The company targets 40%-50% contribution in the long term.

- Low-tier hotels are being aggressively targeted with 50% growth in Trip-branded low-star hotel room nights so far this year. Management considers low-end hotels as being one of their customer acquisition channels where they target users who already have the intention of travel; they expect these users to upgrade in future by spending more on the platform.

- Business scale has reached 1 bn+ annual transportation tickets (including air and ground) and management sees great opportunities from cross-selling, with 31%/22% of air ticket bookers/train ticket bookers having hotel booking needs, to whom they cross-sell.

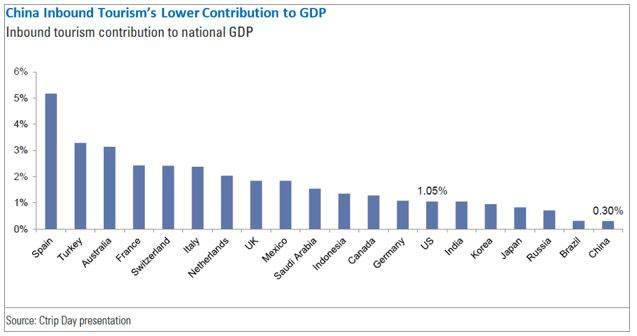

- Trip sees large opportunities in China’s inbound tourism market. There is a large gap between inbound travel as a % of GDP in China v/s that in other countries and management thinks the stagnation of inbound tourism (v/s outbound tourism) is uncharacteristic of the size and maturity of the overall economy. It foresees a potential US$100-200bn incremental growth opportunity, equivalent of 1-2% of GDP.

Similar socio-economic development in other parts of Asia are creating a strong pan-Asian tailwind for travel & tourism within Asia and globally. We find Trip.com to be ideally positioned to benefit from this megatrend.

Summary

It is not too difficult to observe that these megatrends are better defined and visible in China compared to other developing countries in Asia. They are just as omnipresent elsewhere, but given the smaller size of those economies, manifest in a smaller fashion on the world stage. However, when seen collectively in the context of Asia and Asian growth, their contribution to growth becomes meaningful. Hence as investors our endeavour is always to identify players who straddle the pan-Asian growth theme best and which we can buy at the opportune time at valuations which afford us a margin of safety in the long run.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.