Nobel Laureate Paul Samuelson said it best. “Investing should be dull. It shouldn’t be exciting. Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.”

That sums up the idea of dull and boring investing pretty well. Yet, it is hard to reach out for dull and boring when our emotions, along with the media and Wall Street, are singing the song of what the economy will be doing and where to invest. The last few years in particular have been cacophonic. And through it all, to find companies to invest in that chug along at an even pace creating hardly a ripple in the markets in terms of excitement, is a difficult task indeed.

These are companies whose earnings have low volatility, whose stock prices oscillate around a gently upward sloping line and which trot out annual returns that would make an aggressive tech investor blush.

We have been invested in one such company from the outset. When we tell our investors and friends that it is a company based in China, whose revenues and profits are 100% earned in that country, that it is owned by a State Government and that we have been watching like ‘grass growing’, we get some incredulous looks.

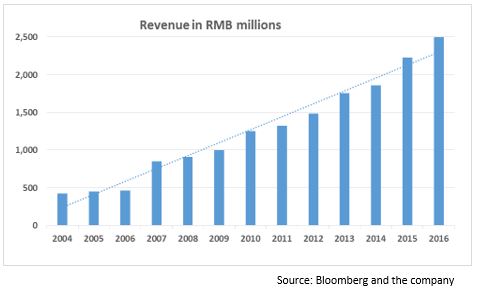

The company in question is a toll-road operator. It is a smallish company by Chinese standards but it remains very profitable, highly cash generative and focussed on growing without excessive effort and whose monthly, semi-annual and annual operational disclosures will warm the cockles of any long term investors’ heart.

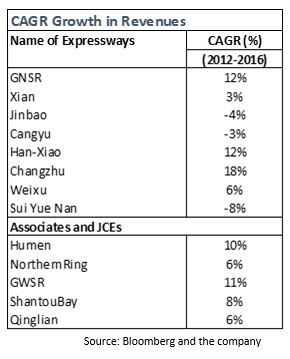

Yuexiu Transport Infrastructure (1052 HK) is one such “dull and boring” company listed in Hong Kong whose toll roads snake across China but chiefly in the state of Guangdong. Yuexiu Transport owns and operates eight toll roads and has stakes in five more as an associate or a joint venture partner. Nearly 18-20 years of lease life remain on its portfolio of owned roads, providing investors access to a maturing portfolio. Tariff hikes are regulated while traffic risk is borne by the operator.

There is nothing remotely exciting tracking a toll road operator, we assure you. One gets monthly toll statistics of vehicles that plied on them and the tollroad-wise toll collected. One tracks them month after month. The roads have long leases so there is hardly any risk of roads going off the portfolio or being sold off or bad-performing roads pulling the portfolio down. The toll rates do not fluctuate much. There is not much for the press to write about toll road operators so one hardly reads or hears anything that is newsworthy about them. These are the quintessential back-benchers of the stock market.

Friendless on the Street: We have owned this stock since early 2014. Since then the stock has never been covered by more than four analysts on the street. It trades around US$1 mn per day and has a free-float of 40%. Clearly large institutional investors would have nothing to do with it. It is almost unknown to the vast majority of investors we know except for some analysts who passively track it and the 3-4 who actively write reports on it. Yuexiu is as friendless as a 50-1 hack at a race in Happy Valley in Hong Kong.

Dividends and Capital Discipline: It has maintained a dividend pay-out ratio of around 65% over the last four years. Dividends have grown from HK$0.20 in 2012 to HK$0.34 in 2016. Dividends are forecast to reach HK$0.396 by 2018. That is a near doubling in six years, a feat not many companies across industry groups would be able to match when it is achieved. This is despite finding enough capital to acquire new toll roads, surrender one, and run a fairly conservative balance sheet where debt/assets has been capped at 40% and debt/equity at 85% in this period. Needless to say, it has never raised equity since its IPO in 1997.

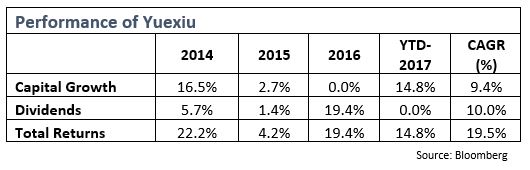

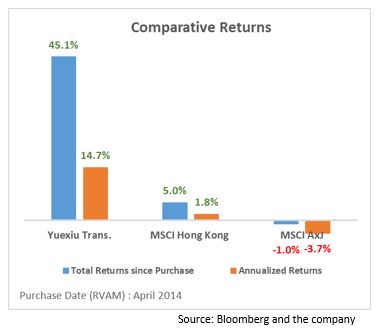

Stock Returns: Yuexiu Transport’s stock returns since our purchase date till date have been stellar. The chart below tells the story in simplest terms. The table below too provides the annual total returns delivered by it.

The Company’s valuation on a 1-year forward basis relative to that of other Chinese toll road operators remains at a discount in spite of its performance being as good or better. History has proved that a stock’s multiple often expands over time as the complexion of its shareholder register changes with its size. Yuexiu’s management seem quietly conscious of this fact and remain focussed doing a good job year after year, leaving the stock market to figure out its value at the appropriate time. Like its management, we simply sit around watch Yuexiu grow. Like green, green grass!

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.