In recent months, economic data in India has flashed warnings a few times. These have been individually flagged by many analysts and commentators in the media. However these have been passed over by the stock market generally, inebriated as it has been on its gains for the year. So let’s enumerate some of these ‘not-so-happy’ tidings first.

- GDP downgrades: GDP growth is now expected to come in between 6.6-6.8% vs 7.2-7.4% previously.

- Inflation itself has come off its lows, elevating forward expectations. At its last meeting, the RBI made no bones about its concern that inflation bore upside risks in the coming months. The media and brokers, however, called the RBI’s stance ‘neutral’ lest it upset the carnival mood in the stock market.

- The Fiscal Deficit at the end of August had already reached 96% of the target. Fiscal slippage now looks like a fait accompli.

- Half-way into the year the Government let loose a balloon in the media that suggested a fiscal stimulus was in the works to stem the rot setting in. The negative reaction was immediate. The Government backed off quickly. It realised that it would be a tacit admission of its inability to kick-start growth and be an embarrassment after the chest thumping of the previous months.

- The current account deficit (CAD) widened to a four-year high of $14.3 billion in the Q1FY18 at 2.4% of GDP compared to 0.1% last year. The widening CAD was driven by a greater increase in merchandise imports than exports. The INR reacted swiftly, climbing over Rs. 65 to the dollar for the first time since March this year and has held its elevated ground since.

- The 10-yr bond yield has backed up from 6.4% to 6.75% despite the loosening of limits for foreigners to buy sovereign bonds recently.

Throughout this period, the steady capital outflows from foreign investors in equity markets continued unabated, even as cash continued to flood in from domestic investors. In the September quarter FIIs sold stocks worth $3bn against which domestic institutions bought stocks worth $6.5bn.

And yet, despite this surge in liquidity, the best that can be said about the equity markets’ performance is that they have remained ‘propped up’ through this period. The numbers tell their tale; the Nifty is up 1.7% vs MSCI India which was up 2.4% and MSCI Asia ex-Japan up 5.7% in US$ terms in the last quarter.

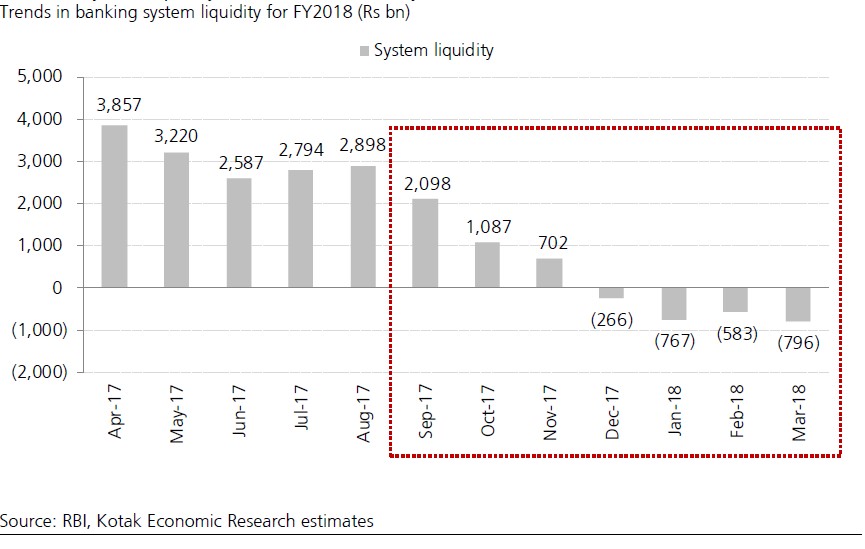

Post demonetisation, the currency in circulation first ran dry and then surged since the start of 2017. That surge has continued till now. This is one of the reasons supporting the demand for sovereign bonds from banks. With a fiscal slippage around the corner and the very real prospect of the RBI cutting back on OMO sales, liquidity is likely to begin tightening soon and become negative at the turn of the year. We agree that the link between equity returns and market liquidity is tenuous, but in the past, episodes of such swings in system liquidity which have not been positive for equity returns are those where global episodes of tightening have tended to coincide.

A recent analysis by Kotak Securities showed their forecasted path of domestic liquidity over the next six months (see chart alongside). If this were to indeed play out, then the potential for a perfect storm lies not too far ahead of us.

Note also that this is the period when the US Fed itself is turning hawkish at the margin. Its bond selling program has been flagged off and the sentimental impact of that potential action on US 10-yr yields is already visible, backed up as they have been from below 2.05% to now nudging 2.4%. How they move in the next few months will surely determine the narrative on rates and impact market returns in Developed Markets (chiefly US) and have an effect on Emerging Markets including India.

The White House will likely announce a Fed Chair nominee in the coming weeks. Former Fed Governor Kevin Warsh’s name is on top of the list of nominees. The markets view him as being more hawkish on where interest rates should be. His appointment may cause some consternation in markets for a brief period of time.

Over in Europe, consensus is veering around to the European Central Bank beginning to ease back on the stimulus, reversing the interest rate cycle there.

Domestic Indian investors seem blissfully unaware of the slow turn in the tide in the economy within India and the direction of the winds globally. After all, emerging Asian markets have been the biggest beneficiaries of loose monetary policies in the West. Even though administered gradually, a persistent tightening of interest rates over time would most definitely have an impact on them.

Indian companies, for instance, have aggressively tapped into the market for rupee-denominated foreign debt, which can work against them if the flow of foreign capital turns volatile. The RBI has been regulating the amount and quality of such borrowings, so it may seem like things are under control for now. It is also known that as much as 65% of the foreign debt exposure of Indian companies may be unhedged. A slightly prolonged period of unfavourable trade balances when combined with volatile international capital flows can lead to macroeconomic conditions becoming unstable yet again.

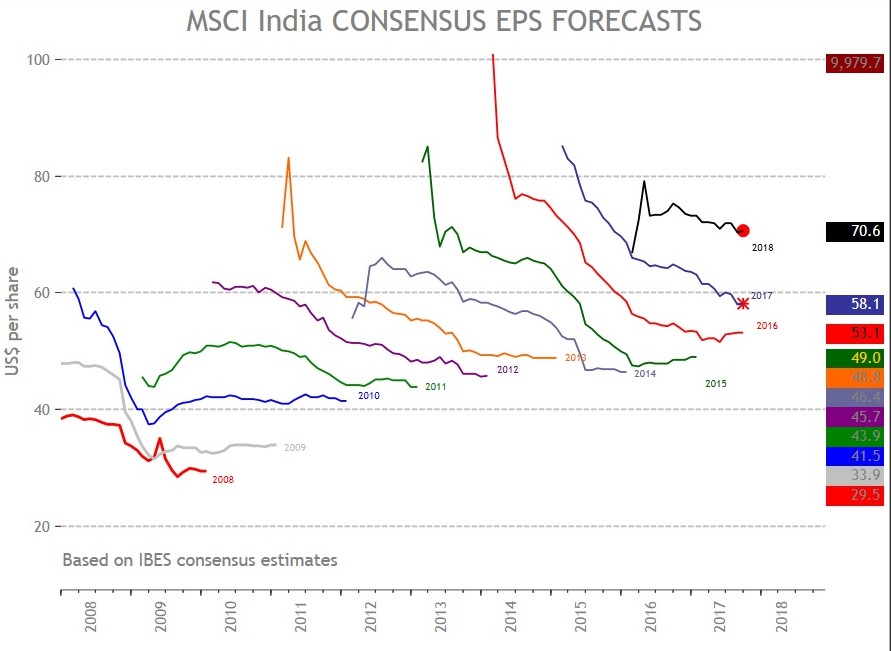

Corrections can be shallow in markets unless they are supported by strong growth and durable earnings constructs. Sadly, that has been a consistent missing link as far as India is concerned. The earnings forecasts have declined from the start of the year, every year since 2011! Nobody expects FY18 to be much different, while prospects for FY19 remain cloudy at best for now, despite the usual dose of optimism. Hence, in the event of an increase in global volatility, a correction in equities in India will not be supported by the strength of corporate earnings growth.

As we have seen before, the bond and foreign exchange markets are the most likely places where the impact is felt first directly and transmitted to equity markets soon enough. Thus far, both markets have bounced off their recent extreme readings and held their ground. Should we get a further jolt here, it will not be long before the equity markets feel the effect, catching many off guard.

The conditions for a perfect storm are in place. Often such conditions dissipate and calm descends over the oceans again. But they need close monitoring from here to see if a storm is indeed forming. The events of the next few weeks will provide more evidence. Our ears are pricked, eyes peeled and sights squarely set on the fixed income and currency markets. Equity index reading in India feels boring!

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.