With markets in India and the world hovering around all-time highs, having stabilized post the volatility scare of early February, we headed off to Mumbai in end February to gauge the ground sentiment. Conferences are a good place to meet old acquaintances, exchange views and feel the pulse of what investors are thinking 4,000 km across the sea from where we sit in the little Red Dot. Mr. Uday Kotak, Vice-Chairman of Kotak Mahindra Bank, was the star attraction the first morning at the event we attended. And he didn’t disappoint.

Having made returns above expectations in 2017, the one question on everyone’s mind was – what next? That feeling was more acute in India, given the diverging signals between macro and micro. What struck us was the lack of global diversification in the Indian investors’ asset basket. Most investors said, “Why bother investing globally when growth in India is strong?” No doubt India has one of the best set of bottom-up opportunities in Asia (including some new ones that we discovered), but, over the long run, real returns get impacted by issues like exchange rate and inflation. We spent some time looking at the net long run Indian returns in a global context.

The Conference

Mr. Kotak’s opening salvo made sure any dreary-eyed soul suffering Monday morning blues in the audience got his attention. He fired off by stating that he was seeing ‘growth re-surface’ strongly in some places, but the India story was changing dramatically this year. The macro was deteriorating but the bottom-up story was improving. That has now become the most trotted-out narrative on India since that Monday morning.

We couldn’t agree more. In fact, we had flagged, back in October 2017 in our newsletter titled “Storm Alert”, several of the risks he mentioned and they are now making the headlines. That was back when the bulls were on a rampage and money was flooding into mutual funds’ coffers.

Several macro-indicators are now beginning to blink amber and there is some consternation in the ranks of portfolio managers. They are beginning to feel the fatigue of years of chimerical earnings growth and of hope being dashed time and again by some extraneous event. However, talking to companies, we got a better feel of the economy.

Macro Headwinds

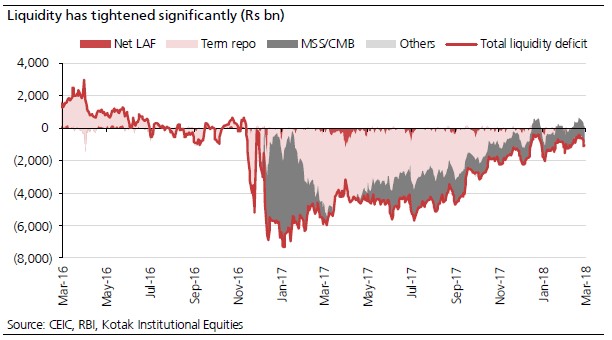

After a few years of benign interest rates, the cost of capital is reversing, in India as well as the world. Globally a synchronized global growth pick-up is driving central banks to reverse their accommodative stance, while in India the RBI is tightening liquidity. The stock markets are in a flux as they try to figure out if this is likely to be evanescent or enduring in nature. The RBI itself has been prodding markets not to lose sight of inflation. It has been an inflation-targeting central bank for some time now and therefore its current vigilant stance is not surprising. Thus far, the Indian market has taken sombre growth, a slipping fiscal situation and post-GST angst in its stride and is looking through the foggy data with a ray of hope. As we mentioned in our previous piece, the financialization and liquidity burst (post demonetization of November 2016) was a one-off event and, as it works through the system, a tighter regime could be the norm going forward.

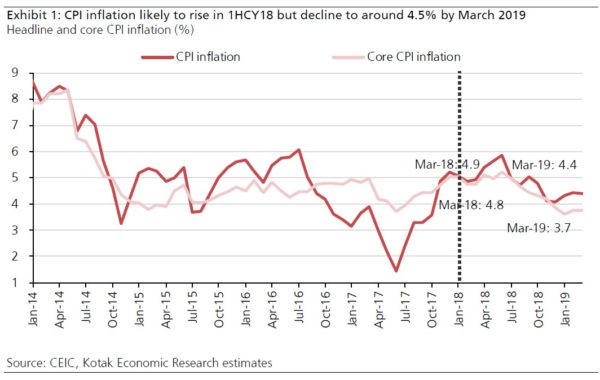

But, as the next chart from Kotak Securities shows, CPI is likely to drop away to end the year closer to 4% after reaching a potential peak of 6% around June 2018. This is also the period when the south-west monsoon arrives in India. Consequently, this year’s rainfall will assume extra importance from an economic and political perspective.

One of the guest speakers pointed out that the agricultural support price (MSP)’s to be announced this year based on the new formula of 50% above cost of production, could be a wild card. Is it going to be a massive dole for farmers sneaked in by the Government ahead of an election year? If MSPs rise by too much, they will feed into inflation one way or another, the speaker said. The market will see this as economics being sacrificed at the altar of political expediency. Lots of questions, few answers are what make 2018 a year of unknowns for the Indian macro outlook.

Come June the bulls will be fervently praying to the gods to shower their bounty, lest a failure lead to moderately high or even rising inflation, which could force the RBI’s hand in the second half of the year. That would deal a nasty blow to the bull market if it were to eventuate. If the rains deliver, that might accelerate the incipient economic recovery that we are seeing now into a more full-blown one, which could then reach more sections of the economy in the months beyond. The hope is that a strengthening economy and low inflation will be good for Mr. Modi and his party to win a second term in office in the 2019 general elections, removing political uncertainty from the picture.

The set-up then for the second half of the year is balanced. There is potential for the rally to come unstuck thanks to a weakening macro-economic picture, where a slipping fiscal deficit and rising inflation and bond yields make for a heady cocktail to knock the bulls out for some time, given high valuations. But then the reverse could be equally true. Good rains, softening inflation and the economy motoring ahead, could lead inflation lower, bond yields off their perch and the fiscal deficit may not slip as feared. If earnings accelerate, valuations could then be justified.

Interesting micro-opportunities

What one loves about Indian conferences is the plethora of interesting companies, each with its own unique story of tackling micro challenges and generating returns, regardless of market gyrations. So, sitting through the meetings at the conference and listening to a varied mix of speakers and corporates, it is apparent that the economy is slowly but surely extricating itself from the demons of demonetisation and the ham-handed implementation of GST. There is optimism, yet again, among corporates that a recovery is or should be underway, now that GST-related issues are being sorted out. In the accompanying paragraphs we give you a flavour of what we found interesting.

A large plastics processing company which is a supplier to a wide swathe of users from petrochemicals, pharmaceuticals, agriculture, transport and logistics sectors, was emphatic that their factories are humming faster now than they did in the first half. Not just in India, this niche player has carved a name for itself across emerging economies in Asia and in its emerging product set is the largest player globally with a 22% market share.

One of the PSU banks we met mentioned that their retail book is growing faster than it ever has and that it was a bright spot in an otherwise super-stressed period (of asset quality concerns). Another NBFC also confirmed that the rural economy was getting back on its feet and its gold loan book was looking up while its other arms were seeing better traction. A couple of IT companies we met spoke of how their past efforts, mainly in sales and marketing, adoption of digitalisation and automation of their processes, are seeing them winning big against entrenched larger, slothful competitors. They also stated that global growth was looking up in pockets and that Indian IT could see better days ahead, not in general but for those who had prepared for the changed times.

In spite of a weak property market, a leading housing finance company emphasised that the new RERA regulations were a game changer for the sector and that his company could not have wished for more. Indians are signing up for mortgages consistently, growth has been in the mid-teens through the testing times of last year. The company did not seem too perturbed about whether it could grow but was focussed more on improving its margins and keeping its balance sheet as pristine as it has been.

We also sat in on a few first-generation entrepreneurs talking about their businesses. The common take away was that opportunities in India abound for those with the courage to seize them. Indian consumers are only beginning to sample foreign brands and services in abundance, where they have choices to make at every level. Competition has stepped up several notches in many sectors and incumbents are feeling the heat there. But in others, the early birds are catching the proverbial worm, and fast. Our mind started wandering, if Indian consumers are ready for global products, maybe it’s time for Indian investors to get introduced to global investing also.

There are businesses which are innovating to meet specific socio-economic difficulties. An entrepreneurial company in the logistics sector caught our attention. It is making logistics and road transport not just technologically-enabled but more humane and hence is having a direct positive social impact as well. The CEO explained that he used a relay of truck drivers who passed a truck on like a baton, before it eventually reached its destination. He cited an example where a truck from Bangalore to New Delhi would have as many as sixteen drivers driving it. Conventionally a single driver goes through the whole journey taking extended rest periods, often drinking and driving, staying away from his home and family for days, often weeks. This led to social and health problems and partial unemployment when the drivers did not get driving jobs and that often led to them having to forsake their farms in the villages. Now they could drive a truck for a few hours or a day, pass on to the next relay driver, and spend time at home as turnaround times were short and they stayed fresher and healthier and with their family life intact. For customers, the deliveries were, in fact, speedier and more reliable and technology enabled them to track their cargo in real time.

With so much going on in India, the crowd at the conference seemed undiminished in its enthusiasm for the stock market. The common refrain was to buy the dips. They believed that the gusher from retail investors into mutual funds was a structural shift that would flow into the markets unabated.

We sat, at the end of the day, sipping Bira, India’s new-found beer love (another entrepreneurial venture), soaking it all in – beer included. India appears to have found a new wind in its sails. Optimism abounds, the spirit is rekindled and risk-taking is back. A new breed of entrepreneurs is taking birth, funded not by traditional sources of capital such as banks, but by private and public markets. Crowd funding is being talked about and private financing is par for the course. If the stock markets are reflecting this mood, it is not very surprising.

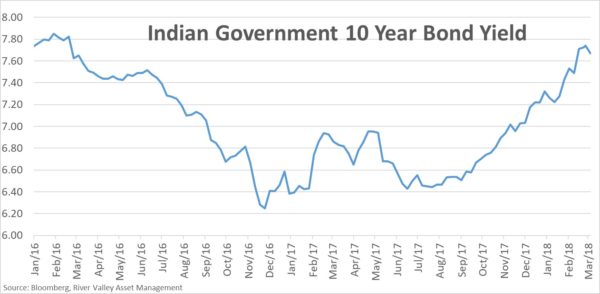

That is the reality on the ground. However, for the markets, the 10-year bond yields have traversed a fairly long distance from 6.4% in July ’17 to 7.8% in Feb ’18, while the Rupee (INR) has stayed firm despite relentless oil prices. The stock market has had a wobble in February this year and has yielded about 5% off its peak. This has subdued the mood somewhat, but not to the point where the bull market itself is under question. The troika of inflation, currency and bond yields have reappeared on the horizon, threatening to derail the rally of 2017. Earnings growth will now have to be the offset and will need support from the weather gods come June.

The stock market must deal with fluctuating news flows on multiple fronts including a political battle in a key southern state where another BJP victory could bring some solace to a market desperate for good news to resurrect itself. This period of adjustment is exactly what the long-term bull market in India perhaps needed. Time for a pause. A time for reflection, adjustment and recalibration of expectations. Whether this is going to be a short-lived adjustment to a more sobering macro-economy or a pause before growth springs forth and flourishes soon, only time will tell. Perhaps some cleansing would not be bad, given the excesses from the heady rally of 2017.

Indian Markets in a Global Context

As a correction has set in, it is a good time to reflect on India’s stock market returns in the context of its own domestic investors’ expectations and of those residing globally who invest in its stock market, be it global funds or individuals. Investors need to recalibrate return expectations, delinking it from assessing the growth potential.

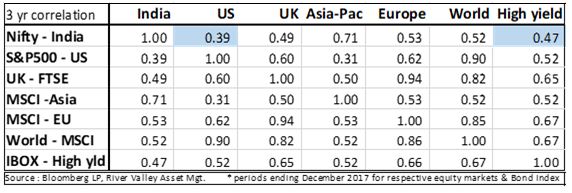

The common myth among market participants (especially within India) is that equity returns in India are superior to those globally. Nominal anchoring ignores real impact of currency depreciation and high inflation in India. Our work shows that long term global equity returns were similar if not better than those in Indian equity markets across various time frames. The accompanying table is instructive and useful. It shows that over a 15 and 20-year time frame, India has delivered returns in US$ that have beaten key global benchmarks; but stretch the time frame longer – over 25 years – and we find that the US has delivered better than India.

There is never a right answer when one compares one market versus other as opportunities come, get competed away and returns revert to the mean. While India has its woes, so too does the world as it needs to adjust to the changing global liquidity conditions in 2018. Central Bank actions are bound to impact capital flows quite sharply in the short term and impart higher volatility to markets than they did last year. Inflation is the joker in the mix.

Staying away from markets is never an ideal solution when faced with uncertain periods. Instead focus should be on building a well-diversified portfolio which can handle the gyrations of a single market, security or asset class. The best way to preserve and grow wealth in the long run is to be invested in a portfolio of equally attractive opportunities but having low correlation. And when we look at the correlation of Indian markets with other equity markets globally we find great opportunities to build an optimum portfolio to maximize risk adjusted returns. Both the US and Indian equity markets have generated good returns over the long run, but with very low correlation. A combination of the two makes for a resilient portfolio. Similarly, as highlighted in the past, our strategy of adding high-yield bonds to a mix of equity securities provides the ability to generate consistent returns with low volatility.

The Indian market set-up is intriguingly poised. In what looks like a normalising year, the bull market in India is being challenged by buffeting factors, its ability to stay the course coming under the scanner. The coming months will find investors struggling to generate returns as a correction sets in. If so, it would be easy to rationalize that it is in the fitness of things and good for the longer-term health of an enduring bull market. In the meantime, investors instead of vacillating between euphoria and panic, need to start building resilient diversified portfolios.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.